Central Bank Digital Currency – CBDC is a digital form of currency, presented on a blockchain ledger. Whether a Central Bank Digital Currency – CBDC, acts as a boon or disaster for the financial ecosystem, purely depends on the functional and technical design of the CBDC.

There is no universal design for a CBDC laid down by the Bank of International Settlement and World Economic forum however they have laid down the following design considerations for a successful transition of fiat currency to CBDC, which are as follows1CBDC whitepaper. Ripple. (n.d.). Retrieved January 28, 2023, from https://ripple.com/lp/cbdc-whitepaper/: –

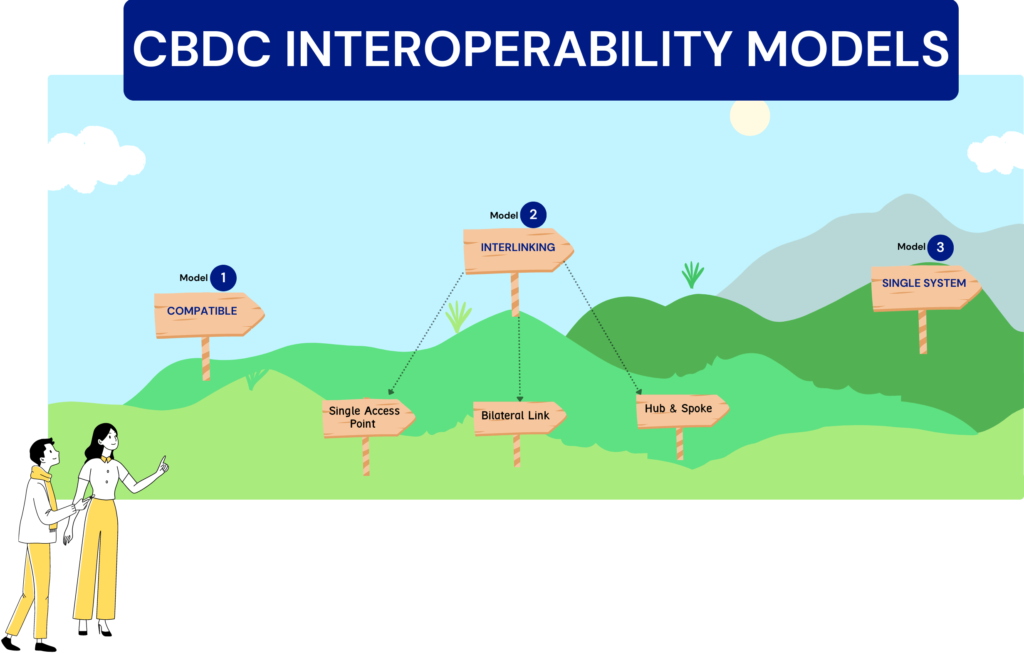

Interoperability

Interoperability is an important design consideration of Central Bank Digital Currency. This makes a CBDC, eligible to transact with other country’s network by following a certain set of common standards for transactions.

Although each country is free to design its own CBDC, each is taking interoperability design considerations quite seriously. A non-interoperable CBDC shall lead to a fragmented financial system and the world can’t afford to have one at this stage in time (post covid).

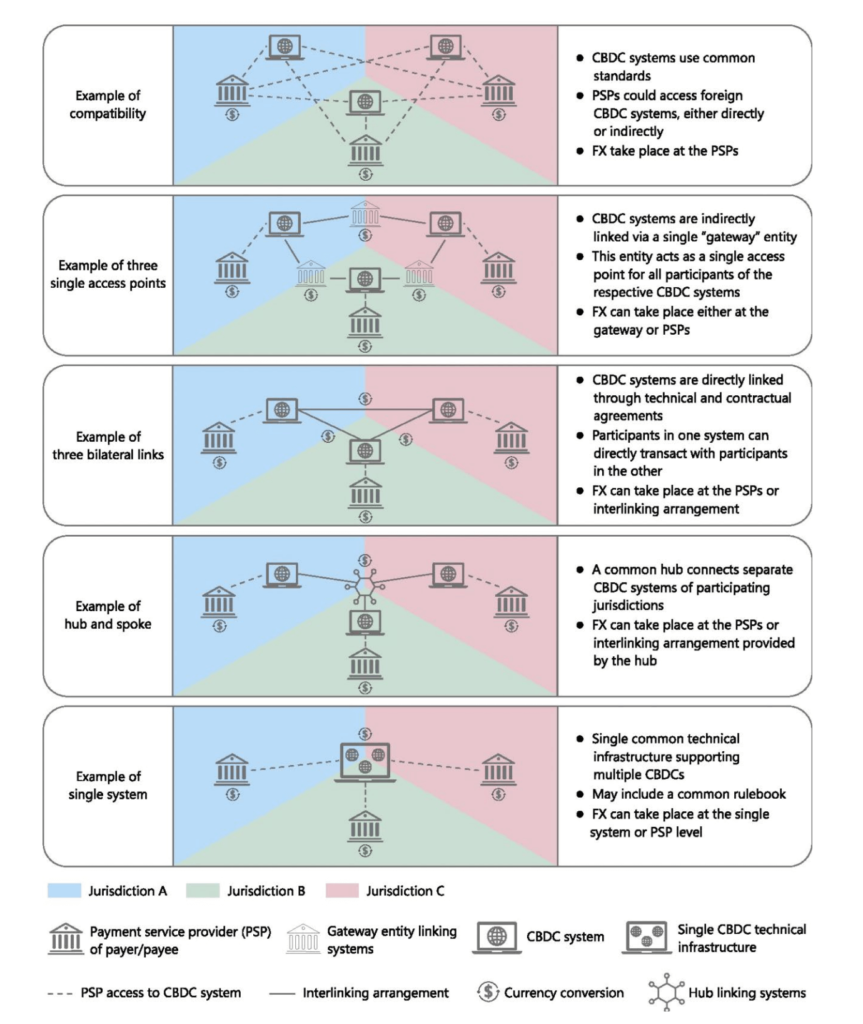

The interoperability design shall focus on allowing transactions between two different CBDCs, two different CBDC systems, and even CBDC and non-CBDC systems. As per BIS (Bank of International Settlement), The interoperability between CBDC can exist as2Options for access to and interoperability of cbdcs for cross-border payments. The Bank for International Settlements. (2022, July 11). Retrieved January 28, 2023, from https://www.bis.org/publ/othp52.htm:-

1. Compatible Model

Unlike cash transactions, digital transactions generate a rich amount of data, and thereby it creates an opportunity for a lot of institutions to use it for commercial purposes without the consent of the individuals.

The interoperability in this model is achieved by using a common message data format standard such as ISO messaging standard3What is ISO 20022? Swift. (n.d.). Retrieved January 28, 2023, from https://www.swift.com/standards/iso-20022 or blockchain techniques which can help in reducing the friction between participating financial institutions.

2. Interlinking Model

The interlinked model is a framework of contractual and technical agreements along with the ability for compliance and currency settlement between different CBDC systems. To facilitate the transaction, a common payment gateway exists which is aided by a regulated currency provider.

The interlinking model can be exist as: –

a) Single Access Point

b) Bilateral Link

c) Hub and Spoke

3. Single System

The single system interoperability model aims at creating a single platform, with infrastructure that shall support transactions between multi-CBDCs (m-CBDC) with a common rule book for various CBDCs present on the platform. One such prototype for m-CBDC platform is Project Dunbar which is conducted by BIS4Project Dunbar: International Settlements Using multi-cbdcs. The Bank for International Settlements. (2022, March 22). Retrieved January 28, 2023, from https://www.bis.org/about/bisih/topics/cbdc/dunbar.htm

Privacy

To protect the commercial/illicit use of the data generated, the underlying CBDC technology, shall limit access to only the authorized stakeholders. Some of the technologies that can be incorporated to limit the control over the data generated during CBDC transactions are as follows:-

a) Blind Signature5How to issue a privacy-preserving central bank digital currency, SUERF policy brief .:. suerf – the European money and Finance Forum. SUERF.ORG. (n.d.). Retrieved January 28, 2023, from https://www.suerf.org/suer-policy-brief/27227/how-to-issue-a-privacy-preserving-central-bank-digital-currency

b) Private decentralized ledger

c) Zero-Knowledge Proofs

The data from CBDC transactions should ideally be used only by the government or authorized third-party institutions to validate the transaction for compliance and AML/CFT (Anti-Money Laundering and Countering the Financing of Terrorism) and if required, to trace the transaction.

Security

Since CBDC transactions take place online, therefore it becomes a potential target for cyber threats such as counterfeiting, data infringement, system integrity, network hacking, quantum threats, fraud, and double-spending. A failure in CBDC network security can cause devastating effects on the financial system and thereby its ripple effects on the economy(s)

Also, check ‘Potential Risks of a Central Bank Digital Currency’ for further insight

Out of the various models being evaluated by the central banks following are the two most talked about models6Minwalla, C. (2020, June 24). Security of a CBDC. Bank of Canada. Retrieved January 28, 2023, from https://www.bankofcanada.ca/2020/06/staff-analytical-note-2020-11/:-

1) Centralized Distributed Ledger Technology

In this technology, the transactional data is distributed across multiple databases called blocks, at the same time. To infringe this data, an individual shall need to access all the blocks/ledger, at the same time, retrieve the data and then proceed. Since a single transactional data is distributed in bits and pieces across blocks, it is next to impossible to access and alter the data from blocks.

The blocks/ledger, where the information resides are in the control of the centralized federal government agency. The access is provided through dedicated firewalls, links, and whitelists7Hansen, T., & Delak, K. (2022, March 2). Security considerations for a central bank digital currency. The Fed – Security Considerations for a Central Bank Digital Currency. Retrieved January 28, 2023, from https://www.federalreserve.gov/econres/notes/feds-notes/security-considerations-for-a-central-bank-digital-currency-20220203.html.

2) Permissioned Distributed Ledger Technology

Permissioned Distributed Ledger technology is almost the same as Centralized Distributed Ledger Technology with the only difference of the stakeholders who control the network. In Centralized DLT, the federal agency or the Central bank solely controls the ledgers/blocks whereas in Permission Distributed Ledger Technology, various organizations/members control the nodes and the data stored in them. This makes Permissioned Distributed Ledger architecture slightly decentralized in nature8World economic forum. (n.d.). Retrieved January 28, 2023, from https://www3.weforum.org/docs/WEF_CBDC_Technology_Considerations_2021.pdf.

This is a less preferred model by the Central Banks across the world, since, if a member controlling the node/ledger misuses the control, it can compromise the whole network.

Cross Border

Currently, the cross-border transaction takes up to 10 working days9Contributor, R. (2020, November 20). How long does a bank transfer take?: Revolut. Revolut Blog. Retrieved January 28, 2023, from https://blog.revolut.com/a/how-long-does-a-bank-transfer-take/ to credit the payment in the beneficiary’s account. This is due to the involvement of correspondent banks which act as intermediaries in completing a transaction. Since these intermediaries’ banks have working hours and any transaction made outside the working hours shall need to wait till the next working day, therefore, the current cross-border financial system faces a lot of friction in moving money.

The aim of CBDC should be to reduce the time taken for cross-border payment, to a few minutes by making the CBDC design interoperable between networks. A lot of private players like Ripple and Stellar are helping countries around the world, design CBDC by keeping interoperability as the main design consideration10Ripple | instantly move money to all corners of the world. (n.d.). Retrieved January 28, 2023, from https://ripple.com/reports/cbdc-whitepaper-2020.pdf.

Project Dunbar was conducted by involving the Bank of International Settlement, the Central Bank of UAE, the People’s Bank of China, the Bank of Thailand, and the Hong Kong Monetary Authority, where the interoperability of CBDC was tested on a multi-bridge (m-bridge) network11Project mbridge: Connecting economies through CBDC. The Bank for International Settlements. (2022, October 26). Retrieved January 28, 2023, from https://www.bis.org/about/bisih/topics/cbdc/mcbdc_bridge.htm.

A similar test was done by JP-Morgan12Liquidity management in a multi-currency corridor network. J.P. Morgan. (n.d.). Retrieved January 28, 2023, from https://www.jpmorgan.com/technology/mCBDC where Singapore US Dollar CBDC and Euro CBDC were exchanged on the Quorum network. In these projects, the cross-border transactions were conducted which were completed in minutes.

Technical Resilience

Once CBDC goes live, it shall be at the center of the financial system and therefore in such a scenario, CBDC ought to be resilient to counterfeiting, technical failures, and cyber-attacks.

As per the BIS13Bank for International Settlements. (n.d.). Retrieved January 28, 2023, from https://www.bis.org/publ/othp42_system_design.pdf, a parallel technical infrastructure to an existing payment infrastructure shall make the CBDC network robust. In case, if there happens to be a cyber-attack on the primary CBDC distributed ledger, the parallel infrastructure can be made as primary, and the transactions can resume without any delay.

Further, to make CBDC architecture technically resilient, the possibility of offline payments using CBDCs is being explored14Imagining an open future for payments: Imperatives for a recovery – visa. (n.d.). Retrieved January 28, 2023, from https://usa.visa.com/dam/VCOM/global/sites/visa-economic-empowerment-institute/documents/veei-imagining-an-open-future.pdf. This shall be helpful in case if the connectivity with network fails due to power outage.

Flip the Chain Thought :- If CBDC is built on an Online Blockchain Ledger, How can it work Offline?

Sound Technical Governance

The type of CBDC network, hosting, infrastructure, distributed ledger model, AML/CFT laws, ability to audit the network easily, the robustness of underlying technology, and ease of scalability of the network, shall govern the success of CBDC. Therefore, a government before launching its CBDC should carefully do its homework to consider the technical nitty-gritty of the CBDC ecosystem, in order to have a successful rollout and long-term stable operations of CBDC transactions.

Currently, CBDCs are still in the initial stages of research and launch and therefore the real test for it is going to come in the upcoming years. The design consideration shall be updated from time to time based on the market response and operational challenges faced.

References