A country’s federal government can either decide to control the minting and distribution of the CBDC alone or have a public private partnership to handle the operations effectively. Private players/financial institutions, therefore, shall have a significant role to play in the CBDC ecosystem. The early adopters shall be able to grab a bigger pie of the CBDC environment and build businesses that shall sustain and excel in the new financial system.

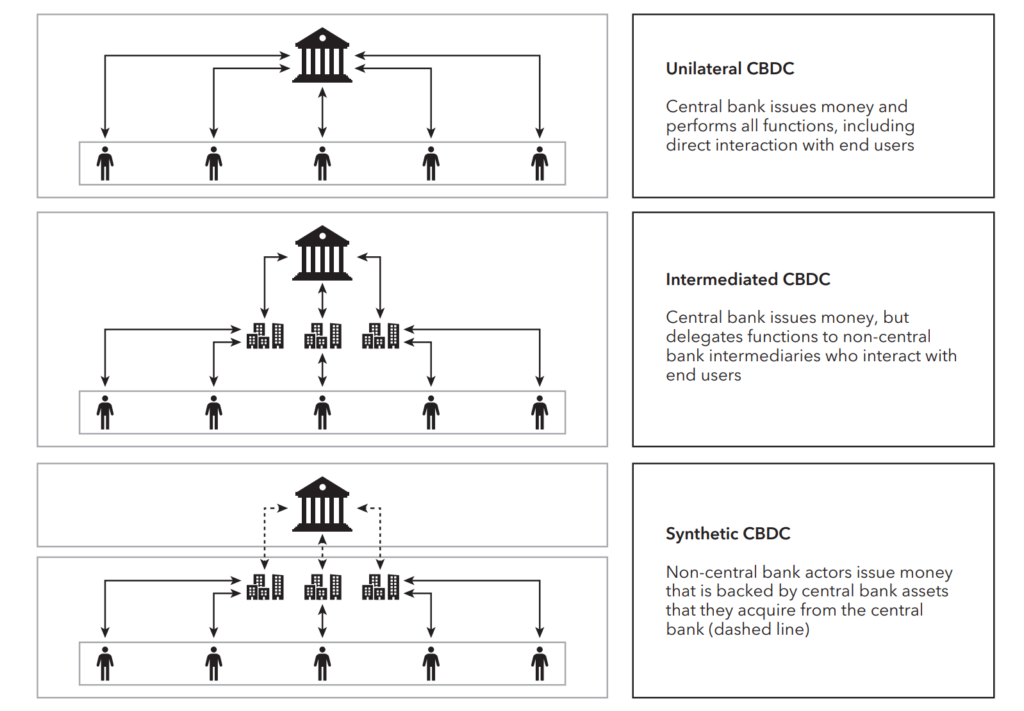

As per the IMF, there is no one-fit model for CBDC (Central Bank Digital Currency) logistics and operations, that can suit all countries across the world. Following are the various models of a CBDC that can exist to run a retail CBDC ecosystem1Gabriel Soderberg, M. B. (n.d.). Behind the scenes of Central Bank Digital Currency: Emerging trends, insights, and Policy Lessons. IMF. Retrieved January 29, 2023, from https://www.imf.org/en/Publications/fintech-notes/Issues/2022/02/07/Behind-the-Scenes-of-Central-Bank-Digital-Currency-512174

CBDC – Unilateral Model

In this model, the Central Bank shall manage the issuance and distribution of retail and wholesale CBDC as well as interact with the end user for the payment.

CBDC – Intermediate Model – Inclusion of Private Players

In this model, Central Bank shall issue the retail CBDC, however, it would be managed by private ‘for-profit’ firms which are also called intermediaries. These private firms can be payment service providers, financial firms, or even mobile phone operators, who shall take a small percentage of transaction fees from each transaction between the customer and the vendor, in order to run their business.

In return, these firms shall be regulated and audited by the Central Bank from time to time.

CBDC – Synthetic Model – Inclusion of Private Players

In this model, Central Bank does not issue the retail CBDC. Rather a private firm will issue a retail digital currency that shall be backed by Central Bank assets. Such type of digital currency issued by a private firm with 1:1 backing by central bank assets is referred to as a Stable Coin or sCBDC.

In this model too, like the intermediate model, the private firms shall be regulated and audited by the Central Banks. To sustain the business, either the private firms can charge an annual maintenance fee from the Central Bank or charge a small percentage of commission from each transaction paid by the customer to the vendor.

Now since, we have anticipated the role of private players in the CBDC ecosystem, it is also important to understand its impact on the traditional banking system and who will bear the cost of the new financial system.

CBDC Operating Model, Costing and Its Impact on Banking System

Will CBDC Adoption Collapse the Banking System?

One of the business models for the banks is to lend money to businesses/individuals and earn interest on it. After the launch of CBDC, there will be a shift of money from the bank account to digital wallets for storing the CBDCs. Some of the countries are already exploring possibilities of providing interest rates, to individuals for converting and saving their money, kept in bank accounts, into CBDC.

Since most individuals would want to keep their money away from the bank account, in digital wallets (especially in countries where negative bank interest is charged, to keep the money in the bank account), the banks would face challenges in lending money to the borrowers, which at the end of the day, would impact their business.

In such a scenario, it makes sense for the bank to pitch into the CBDC ecosystem by being a part of an Intermediate Model or Synthetic Model and generate revenue from the transactions to lend to the borrowers and earn interest on it. Also, at the same time, banks can start exploring getting back the dormant money kept in Nostro and Vostro accounts by shifting to the On Demand Liquidity Platform2US10902416B1 – network computing system implementing on-demand liquidity for cross-medium transaction services. Google Patents. Retrieved January 29, 2023, from https://patents.google.com/patent/US10902416B1/en.

Further, to survive, banks shall need to focus more on selling products like mutual funds, equity plans, health insurance, annuity plans, retirement plans, etc.

Who Will Compensate for the Cost of the CBDC Infrastructure?

Since the Central Bank shall be providing the underlying infrastructure in the Unilateral and Intermediary Model, the private firms might need to pay a percentage of fees collected as charges to the Central Bank to compensate for the running cost of the infrastructure, if maintained by the Central Banks. On the other hand, to help adopt CBDC to the masses, the Central Bank can forgo its fees to keep the transaction cost as low as possible.

Since the CBDC project itself is at a very early stage, what an ideal business model, revenue/profit sharing model in the CBDC ecosystem will be, we are yet to witness it.

References