CBDC, also called as Central Bank Digital Currency is the new world’s digital currency, issued by the Central Banks or Monetary Authority of a nation 1Central Bank Digital Currency (CBDC). Federal Reserve Board – Central Bank Digital Currency (CBDC). (n.d.). Retrieved January 26, 2023, from https://www.federalreserve.gov/central-bank-digital-currency.htm.

To put it in simpler terms, CBDC is a legal tender in a digital form, issued by Central Banks, that can primarily be used to make payments. To further simplify, a $10 US CBDC will be equivalent to a $10 cash note, held by an individual.

So, if Mr. ABC went to Starbucks to enjoy a cup of coffee that costs $15, he shall have a choice to either pay $15 in cash or digitally transfer $15 CBDC using a digital wallet (released and regulated by the Central Bank of the nation).

How is CBDC different from Already Existing Digital Currency?

Currently, across the world, money, in bank accounts, online transactions, and payment apps are in digital form and are a liability of the ‘commercial bank’. Whereas CBDC on the other hand is a liability of the Central Bank and not the commercial bank of that nation 2Central Bank Digital Currencies – Bank for International Settlements. (n.d.). Retrieved January 26, 2023, from https://www.bis.org/cpmi/publ/d174.pdf.

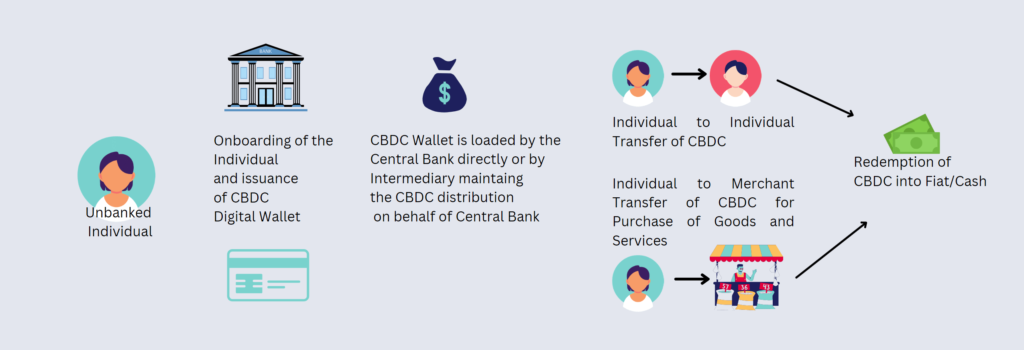

This means that if one had to hold CBDC, he/she might need not go through the commercial bank. This can help in bringing the unbanked population of any nation under the umbrella of digital money by reducing the cash circulation in the economy and increasing digital transactions at the end of the day.

This would help strengthen the nation’s payment infrastructure using CBDC, by reducing the reliance on foreign payment partners like VISA, Master Card, etc. where a considerable commission per transaction is shared with them.

To compete with these foreign payment partners, the Central Banks can decide to keep a minimal or no transaction fee on payments made by individuals, to the vendors to purchase goods or services.

Depending upon the end user and to effectively manage the issuance, distribution, and justify the used cases, CBDC has been designed as Retail CBDC and Wholesale CBDC.

Why do Countries Suddenly Want to Launch CBDC?

The 2008 recession witnessed banks going bankrupt, years of hard-earned savings vanishing in seconds, shortage of cash at the ATMs and banks. This made a group of think tanks, and IMF sit together and come up with a better way of handling money circulation in the economy, and the idea of CBDC was born. Further, Covid 19 and the 2020-21 depression in the economy, ignited the urgency of the CBDC launch.

Money is issued by Central Bank, however, the money that the general public has is issued by a commercial bank. If the commercial banks fail, the savings are therefore gone. However, if the money issued by the commercial bank was to be replaced with Central Bank’s Money i.e., CBDC directly into our digital wallets, the worry about losing savings, because of commercial banks going bankrupt, will no longer be there.

Further, CBDCs are being designed to work even offline4Taking digital currencies offline – IMF. (n.d.). Retrieved January 26, 2023, from https://www.imf.org/en/Publications/fandd/issues/2022/09/kiff-taking-digital-currencies-offline. This shall help as a contingency plan if all the existing payment systems fail.

Do you have CBDC and Want to Travel Abroad? Can I Load my CBDC Digital Wallet and Pay with it Directly in the Foreign Land?

Non-Institutional individuals or the general public can hold retail CBDCs in their wallets. If retail CBDC is designed as a ‘token-based CBDC’, it becomes easily available for foreigners to access.

To achieve this scenario, two digital wallets belonging to, 2 different countries can be connected via a common CBDC currency exchange market platform and the individuals can thereby buy or sell the CBDC tokens easily.

So, no need to carry Credit cards next time. Just load up your digital wallets with CBDC using Credit Card or by converting the money present in your bank account into foreign currency’s CBDC token. These converted CBDC tokens would be present in your digital wallet and the payments can be made by tapping the mobile on the merchant’s QR code in the foreign land5Cross-border payments for central bank digital currencies via … – visa. (n.d.). Retrieved January 26, 2023, from https://usa.visa.com/content/dam/VCOM/global/ms/documents/veei-cross-border-payments-for-cbdcs.pdf.

Will CBDC Replace Cash?

According to the US Federal Reserve6Board of Governors of the Federal Reserve System. (n.d.). Retrieved January 26, 2023, from https://www.federalreserve.gov/cbdc-faqs.htm#:~:text=2.,to%20reduce%20or%20replace%20them and IMF7https://www.imf.org/en/News/Articles/2022/02/09/sp020922-the-future-of-money-gearing-up-for-central-bank-digital-currency, CBDC is not here to replace cash. Rather it shall complement the cash already present in circulation. The long-term plan with CDBC is to reduce the cash transactions and increase the transactions using CBDC; therefore, it is being visioned as the future money.

IS CBDC a Crypto Currency and Can I Invest in CBDC to Gain Profit?

Most Central Bank Digital Currencies are built on blockchain technology (distributed ledger or centralized ledger), but these are not cryptocurrencies.

CBDC and Cryptocurrencies are 2 unique forms of financial instruments with different characteristics, designed to co-exist. The prevalence of CBDC doesn’t affect cryptocurrency and vice versa. Following are the other differences that exist between CBDC and Cryptocurrencies

| CBDC | Cryptocurrency |

|---|---|

| CBDC is backed by Central Bank’s assets | Cryptocurrency is not backed by any asset unless it is a Stablecoin |

| The price of CDBC is stable and shall rise/fall against other countries’ CBDC based on demand and supply. | The price movement of cryptocurrency is purely based on speculation or an underlying used case of the crypto coin |

| CBDCs are regulated and controlled by Central Banks and intermediary partners. This implies that CBDCs are centralized in nature. | Cryptocurrencies are mostly decentralized in nature as a group of individuals does not necessarily control them. It works based on either Proof of Work, Proof of Stake or Pre mined coins controlled through validators. |

So, in short, CBDC is not an investment instrument, and one should not expect to gain profit while holding CBDC however if you are a big financial group, then there are ways to get engaged with the Central Bank and build a business model around the CBDC ecosystem.

Has any Country Already Launched CBDC?

As per Atlantic CBDC Tracker8https://www.atlanticcouncil.org/cbdctracker/ countries worldwide are either in the research and development phase or are piloting the CBDC with a small set of Individuals. While a majority of individuals are in the research and development phase, a good number of countries like The Bahamas, Eastern Caribbean, Nigeria, and Jamaica have already launched their CBDCs.

India, for example, has successfully tested Wholesale CBDC and is in the planning stage to test the Retail CBDC version with a small group of people on 1st December 20229Ghosh, S. (2022, November 29). RBI to launch Retail Digital Rupee pilot on 1 December. mint. Retrieved January 26, 2023, from https://www.livemint.com/news/india/rbi-to-launch-retail-digital-rupee-pilot-on-1-december-11669741691383.html. Further, since CBDC is envisioned to create a cashless society, the pros, risks, and challenges of CBDC are being evaluated aggressively to make the launch and operation of CBDC as smooth as possible.

References