The Reserve Bank of India in conjunction with the International Monetary Fund (IMF) and Bank of International Settlements (BIS) is working on a project, e-Rupee to replace the cash notes with digital legal tender1Jahan, M. S., Loukoianova, M. E., Papageorgiou, M. E., Che, M. N. X., Goel, A., Li, M., Rawat, U., & Zhou, Y. S. (2022, September 28). Towards central bank digital currencies in Asia and the Pacific: Results of a regional survey. imfsg. Retrieved February 7, 2023, from https://www.elibrary.imf.org/view/journals/063/2022/009/article-A001-en.xml.

Let’s explore the e-Rupee in detail below.

What Exactly is the e-Rupee?

e-Rupee or Digital Rupee is a legal tender issued by the Reserve Bank of India in a digital form with the primary aim to replace or minimize cash transactions and increase cashless transactions2Concept Note on Central Bank Digital Currency. Reserve Bank of India – Reports. (n.d.). Retrieved February 7, 2023, from https://www.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1218#CP56. One Digital Rupee or e-Rupee is exchangeable, one-to-one with Rupee/fiat currency. For example, Rs 1000 in your bank account, when exchanged, shall fetch you 1000 e-Rupee coins in your digital wallet.

When the Rupee is Already Digital then Why is the e-Rupee Required?

Let’s try to understand by splitting it into 3 sections:-

Problems in the Current Financial System in India

1) Liability of Bank

The liability of the money, deposited in the bank accounts, is currently with the banks. In a situation, if the bank goes bankrupt, the money lying in the bank account is lost and the depositors end up receiving nothing or a minimum guaranteed amount which might be quite less than what was deposited into the account.

2) Need for a Bank Account

The rupee currently moves digitally from one source of payment to another by debiting the payor’s account and by crediting the payee’s account however to do so, an individual needs an account with the bank.

3) Not able to Track Money

The money in circulation is injected and distributed into the economy via the banks, and thereby accurately tracking the movement of money in the economy, by the Reserve Bank of India, is not easy.

4) Cross Border Payments

Transferring Rupee, across borders takes up to 5 working days which means that there is a lot of friction in cross-border payments with the current digital form of currency.

One-Stop Solution to the Problems – CBDC

To solve these problems, IMF, BIS along with various countries came up with the concept of a Central Bank Digital Currency (CBDC).

Central Bank Digital Currency or CBDC is the new world’s digital currency. To state it in simpler terms, CBDC is a digital legal tender that shall be used to replace cash and make peer-to-peer or payor-to-merchant transactions easier and quicker.

As per the Atlantic CBDC Tracker, various countries are either researching CBDC or have officially launched it nationwide (for example, The Bahamas) or like e-Rupee which is currently in the pilot and testing phase. While the underlying technology for CBDC, more or less, remains the same across countries (the technology vendors and ledger type shall differ) however the regulatory framework shall differ from one jurisdiction to another.

There are two types of transactions for any currency i.e. a wholesale transaction and a retail transaction. A wholesale monetary transaction takes place between RBI and financial institutions whereas a retail monetary transaction takes place between individuals or between an individual and a merchant. To cater to both these transaction types, the e-Rupee is made available in a Wholesale e-Rupee CBDC and a Retail e-Rupee CBDC form. These together shall help in solving the problems stated above.

How Shall e-Rupee help in Solving the Problems Identified?

1. Liability of Central Bank and Not the Bank

The e-Rupee CDBC shall be minted and issued by the Reserve Bank of India directly to the individuals or with the help of authorized financial partners into the digital wallets of the individuals. The e-Rupee CBDC shall be present as a token with a unique cryptographic identification number similar to the unique number present on the right-hand top side of a Rupee note. This token shall be issued using blockchain technology known as Distributed Ledger Technology. To put it in simpler terms, the e-Rupee CBDC coins created by the Reserve Bank of India shall be recorded on a blockchain ledger.

Unlike in the current financial system, the money is borrowed by the banks from the Reserve Bank of India and then added to the books, and then circulated in the economy. Since banks are the main custodians of the money here, failure of the bank shall mean, depositors, losing their money.

On the contrary, the e-Rupee CBDC, in circulation, will be the actual e-Rupee created by the Reserve Bank of India on the blockchain ledger and shall be present directly in the digital wallets held by Individuals. This means that the individuals shall not need to worry about losing money in case a bank fails since the money shall be held in digital wallets with the individual himself/herself. This shifts the liability of the Rupee from banks to the Reserve Bank of India

2) No Need for Bank Account

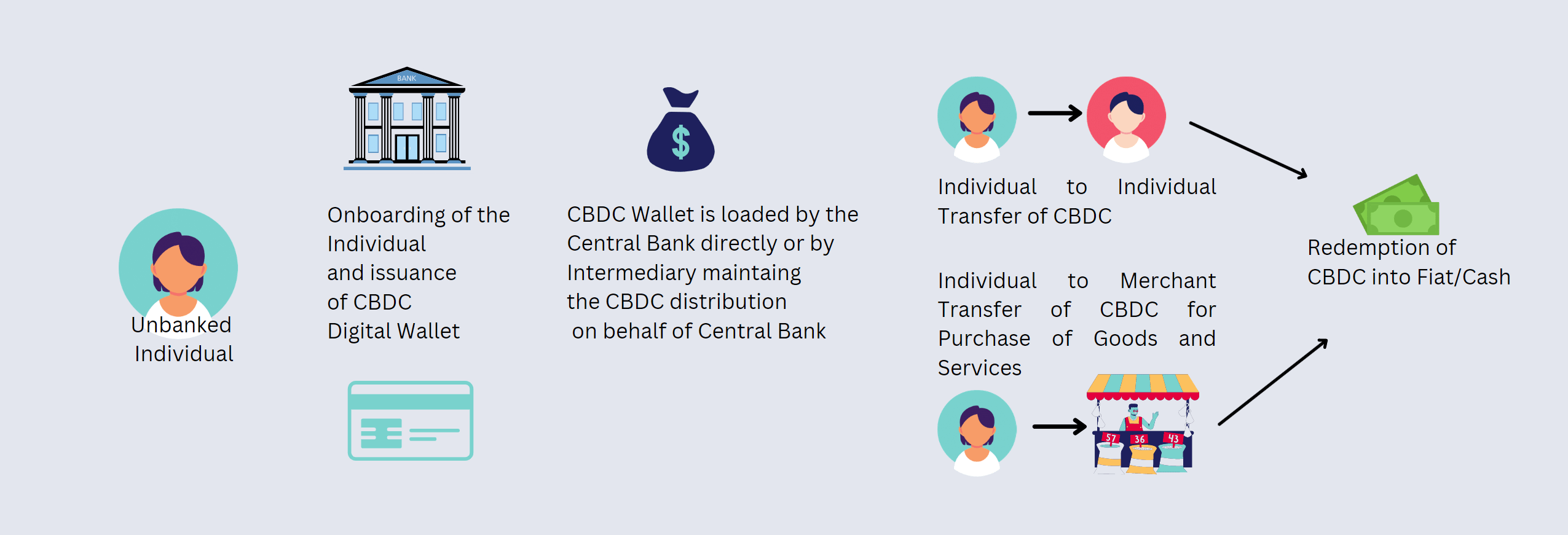

The primary aim of the e-Rupee digital money is to bring the unbanked population into the financial ecosystem by giving them access to cashless transactions. In simpler terms, the aim is to increase financial inclusion in society.

Flip the Chain Thought:- Will e-Rupee lead to Demonetization 2.0?

In the current financial system, to do so, a bank account is needed however with e-Rupee CBDC, a digital wallet shall be required which could be opened with the help of KYC. This means that unbanked individuals, with the help of e-Rupee CBDC in digital wallets (Retail e-Rupee CBDC) shall become a part of the cashless financial ecosystem. However, the Retail e-Rupee present in digital wallets, shall not earn any interest.

Also, retail e-Rupee can be transacted offline, in case of a temporary network loss. This shall help in motivating the merchants to accept e-Rupee digital payments.

3. Tracing Money in the Economy becomes Easier

Since the e-Rupee Central Bank Digital Currency is present and transacted on a blockchain-distributed ledger, and thereby it becomes easy for the Reserve Bank of India to keep track of the movement of money in the economy.

4. Cross-Border Payments

The irony of the situation is that sending an email message takes a few seconds however sending money, cross-border takes up to 5 business days. This implies that at the moment, there is a lot of friction in moving money from one country to another. However, with the introduction of ‘Wholesale e-Rupee CBDC’, cross-border transactions can be reduced to a single day and even a few minutes.

Also, Read – Design and Security Considerations of the e-Rupee CBDC

Some More Used Cases of e-Rupee

Now that we have understood the need for the e-Rupee, let’s try to explore the other used cases, which the RBI is aiming at:-

Subsidy Payment Directly into the Digital Wallets

Since digital wallets shall be issued after KYC, therefore the Government of India shall have a database of individuals who own the digital wallets. In such a case, the government can directly credit the individual digital wallets with a subsidy amount. This shall include the subsidy for LPG gas cylinders, subsidy for electricity, pension payments, reimbursements of contract workers, etc.

Loans

Disbursement of loans currently is quite time-consuming. Specifically considering, MSMEs, the requirement of loans for working capital is quite common however delays in the release of loans can lead to operational and survival issues. With wholesale CBDCs, the time required to disburse lending amounts shall be reduced drastically.

Tax Deduction at Source

VAT is ought to be paid for each transaction. Since CBDC can be programmed, it might be possible for the government, to collect tax at the source of payment (depending on the type of business). This shall reduce the effort of the merchant to file the tax and also reduce the cycle for tax collection for the government.

Reduction in the Cost of Printing Currency Notes

It is estimated3Digital Rupee to save costs of printing, distributing and storing cash. The Economic Times. (n.d.). Retrieved February 7, 2023, from https://economictimes.indiatimes.com/news/economy/finance/digital-rupee-to-save-costs-of-printing-distributing-and-storing-cash/articleshow/89413532.cms that the cost of printing currency notes in India sums to around more than 1000 Crores every year. This cost can be directly saved by replacing the cash notes with digital e-Rupee CBDC. Although there shall be an expenditure on maintaining the technological infrastructure for supporting the CBDC transactions however it shall be quite less than the cost of printing the currency notes.

Tackling Fake Currency

One of the main reasons for crime and terrorism is the presence of fake currency. Malicious actors shall not be able to transact with fake currency after the retail e-Rupee is launched to the general public as it is not easy to counterfeit e-Rupee.

Micro Payments

Currently, there is a minimum transaction amount that one needs to pay to the payment gateway providers, and therefore it is not easy to charge customers amounts in paisa or less than 2 rupees for accessing a limited portion of service. For example, a reader who doesn’t have a subscription for the whole website and wants to read only one article. If the business model of the website supports letting the user read the article for less than 5 Rupees collecting micropayments through retail e-Rupee do wonder in the revenue.

Pilot Experiment of Wholesale and Retail e-Rupee CBDC

There were 2 successful pilot programs done by the Reserve Bank of India in 2022.

1) Wholesale e-Rupee CBDC Pilot

A pilot program for the Wholesale e-Rupee was conducted on 1st November 2022. Amongst the various financial institutions involved, a few well-known banks namely, SBI (State Bank of India), HDFC Bank, ICICI Bank, Bank of Baroda, Kotak Mahindra, HSBC, Yes Bank, Union Bank of India and IDFC First Bank were involved.

During the pilot program, daily settlement, worth 2 billion e-Rupee in the secondary securities market was conducted for over a week4Kalra, J. (2022, November 21). What is the wholesale e-rupee and why do we need it? bq explains. RBI CBDC Pilot. Retrieved February 7, 2023, from https://www.bqprime.com/economy-finance/rbi-cbdc-pilot-what-is-the-wholesale-e-rupee-and-why-do-we-need-it-bq-explains.The aim of the pilot program was to test the possibility of reducing the settlement time to less than a day as well as check the flow of e-Rupee.

2) Retail e-Rupee CBDC Pilot

A pilot program for Retail e-Rupee was conducted on 1st December 2022 by the Reserve Bank of India. Under the scope of the pilot program, customers and merchants from Delhi, Mumbai, Bhubaneswar, and Bengaluru were included however the plans are to further extend the pilot to Gangtok, Indore, Guwahati, Lucknow, Patna, Hyderabad, Shimla, and Kochi. The banks that were a part of this pilot program are Yes Bank, State Bank of India, ICICI Bank and IDFC bank.

As per Money Control5CBDC pilot: A tale of intense prep, high hopes, and a nagging existential question. Moneycontrol. (n.d.). Retrieved February 7, 2023, from https://www.moneycontrol.com/news/business/cryptocurrency/cbdc-pilot-a-tale-of-intense-prep-high-hopes-and-a-nagging-existential-question-9652461.html the aim of the banks were to include 10,000 customers for testing whereas they were able to get only 100 transactions.

As of 12th July 2023, e-Rupee CBDC is now released for the general public and is available for adoption and usage for peer-to-peer or merchant transfer. Download and feel the power of the technology.

Is e-Rupee a Cryptocurrency and Can I Earn by Trading it?

Just like cryptocurrency, the e-Rupee is built on a blockchain ledger however it is different from cryptocurrencies in multiple ways. Firstly, the e-Rupee is backed by the Reserve Bank of India however cryptocurrencies are not backed by any asset unless it is a stablecoin.

Secondly, the price of the e-Rupee is stable and shall rise and fall against other Central Bank Digital Currencies however the price of cryptocurrencies is purely based on speculations or the underlying used case. This means that the e-Rupee is backed one to one to cash notes and therefore one earns only by trading against different countries’ CBDC on a Foreign Exchange platform.

Thirdly, the distributed ledger for the e-Rupee is a centralized ledger however most of the cryptocurrencies are built on a decentralized ledger.

Can I mine the e-Rupee like Bitcoin?

No, the e-Rupee, can only be minted by the Reserve Bank of India and issued to the citizens. The individuals will have no way to mine the e-Rupee as Bitcoin can. This shall make the e-Rupee environment friendly.

Take Away

Reserve Bank of India is launching the e-Rupee for retail as well as wholesale transactions to increase the number of cashless transactions in India and thereby strengthen the country’s economy. While there are already determined used cases for e-Rupee CBDC, there shall be a lot of opportunities for the private sector to get involved and explore business opportunities in managing the distribution of e-Rupee.

References