As per the IMF’s initiative, countries across the world are developing Central Bank Digital Currency (CDBC) on a blockchain network. While a lot of countries are leading the race and have launched the retail version of CBDC for the public. Whereas a few countries are still in the research phase1Central Bank Digital Currency tracker. Atlantic Council. (2023, June 28). https://www.atlanticcouncil.org/cbdctracker/. India is one of the few countries that has already rolled out retail CBDC to the public, with the help of participating banks. Since the e-Rupee retail CBDC is already launched in India, we shall explore how to use the e-Rupee for transactions for day-to-day purchases.

Also, Read – Is e-Rupee CBDC required if UPI Already Exists in India

How to Use e-Rupee for Transactions?

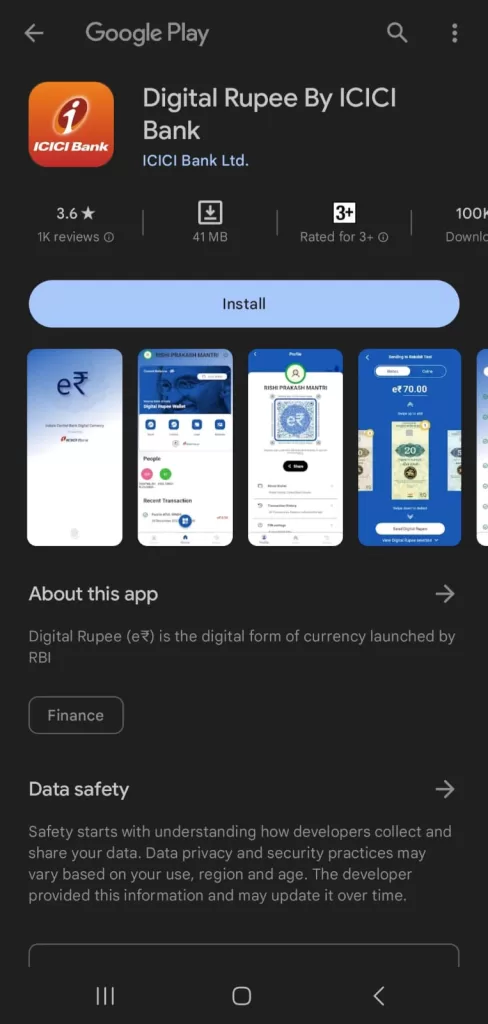

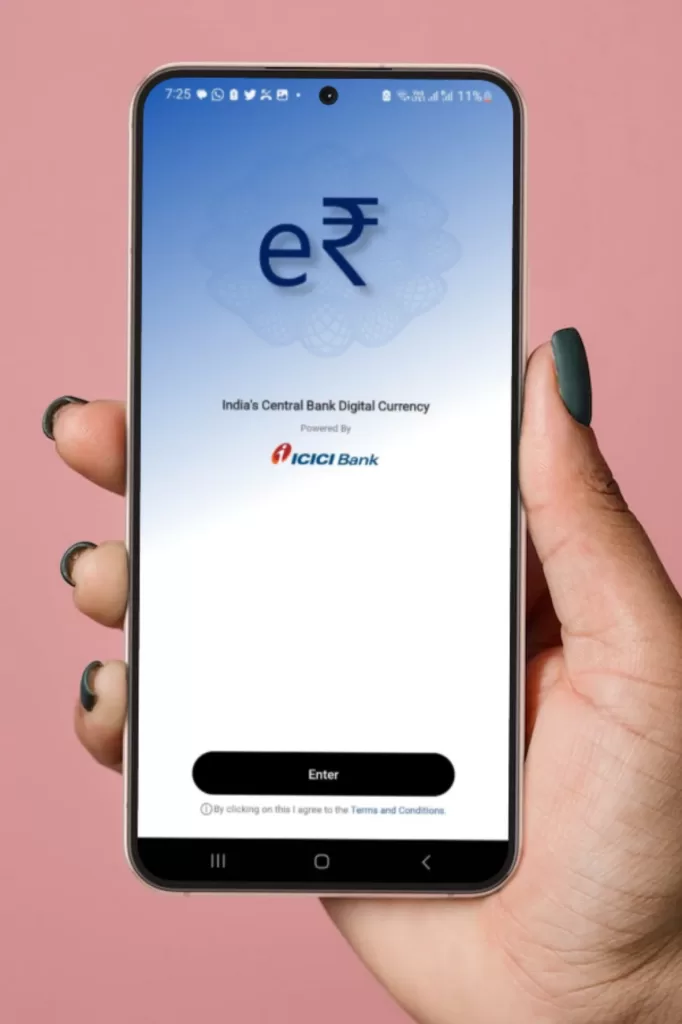

1) Download the e-Rupee CBDC Mobile Application

To start with, you shall need to first download the e-Rupee CBDC mobile application. ICICI Bank, Yes Bank, State Bank of India, HDFC Bank, and IDFC Banks. To start with, you can either download from HDFC Bank2https://play.google.com/store/apps/details?id=org.npci.token.hdfc&pli=1 or ICICI Bank3https://www.icicibank.com/content/dam/icicibank/india/managed-assets/images/personal-banking/online-services/fundstransfer/cbdc/qr-code-cbdc1.webp.

The user interface is the same regardless of whether you download from any bank. The user interface is set by the Reserve Bank of India.

2) Setting up the e-Rupee CBDC Mobile Application

a) Once you open the mobile application the following screen shall load. Click on the ‘Enter’ button to proceed4https://www.icicibank.com/personal-banking/online-services/funds-transfer/digital-rupee.

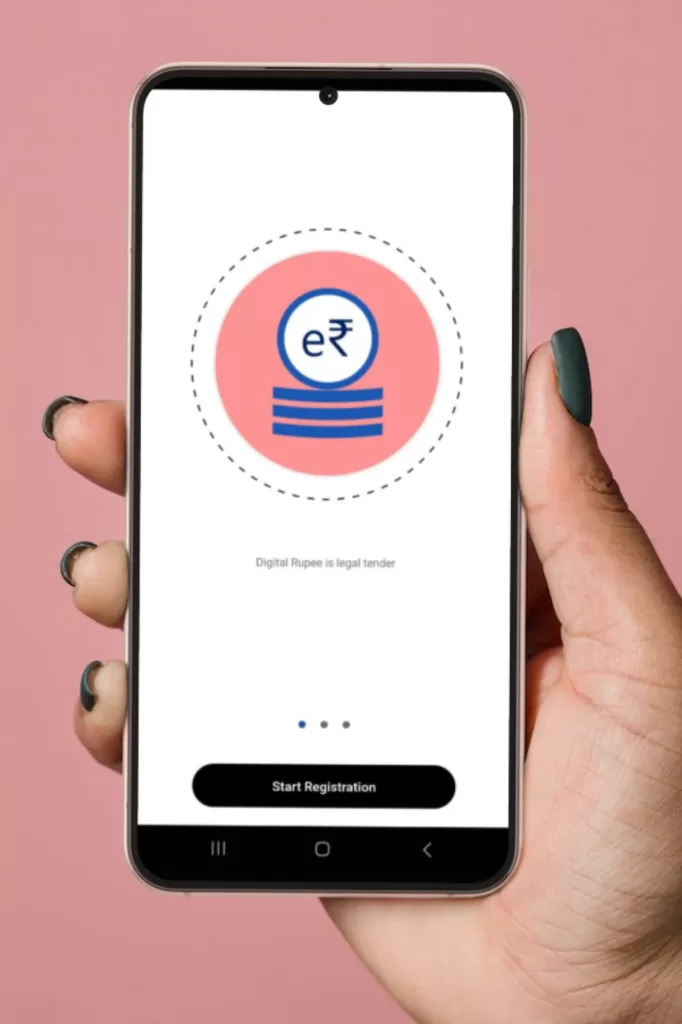

b) After clicking on ‘Enter’ the e-Rupee CBDC application, will prompt to click on ‘Start Registration’ button. Click on this button to proceed.

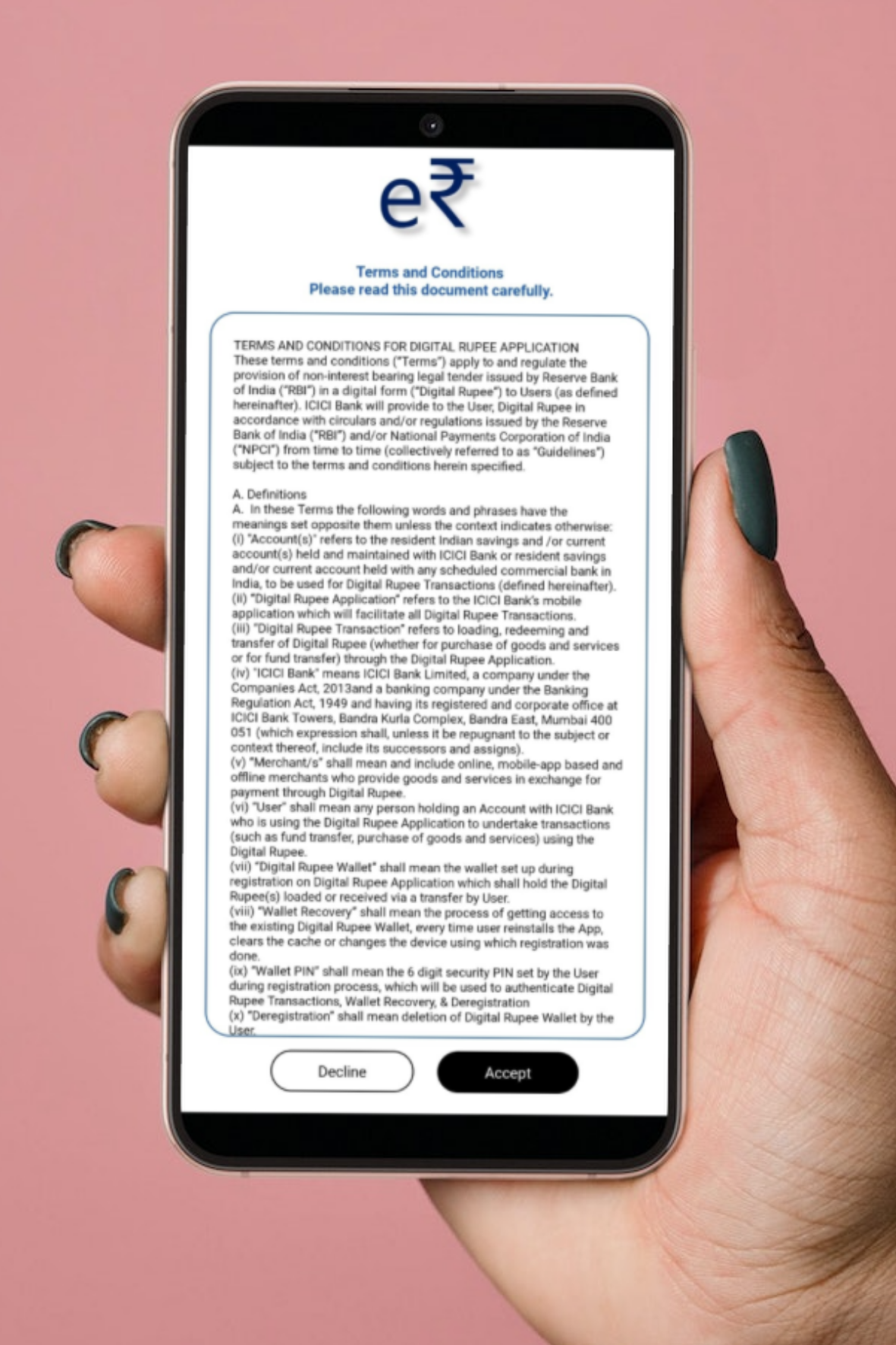

c) ‘Accept’ the terms and conditions to proceed with the registration process.

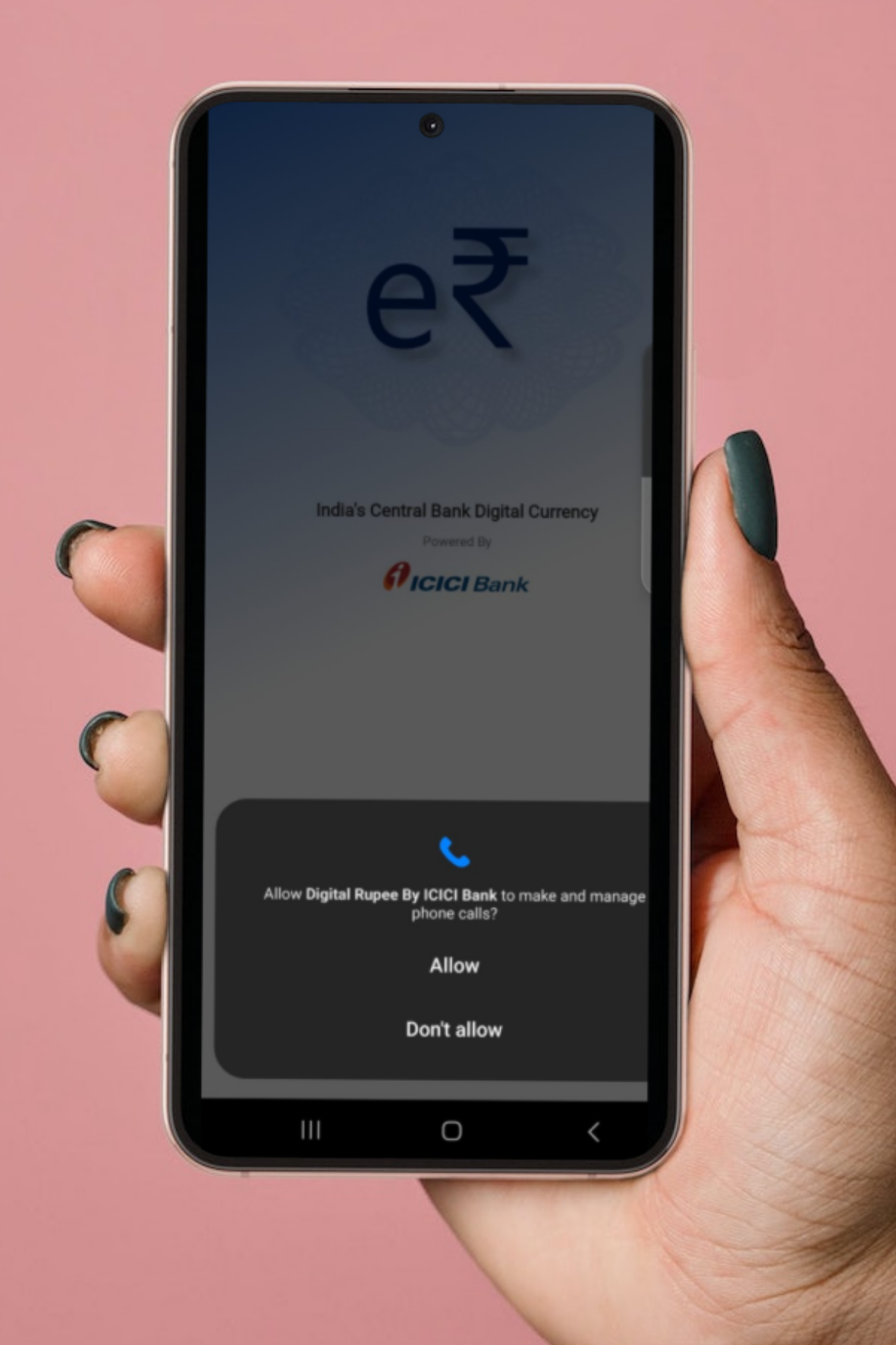

d) After accepting the terms and conditions and next step is to ‘allow‘ the application to make and manage the phone calls

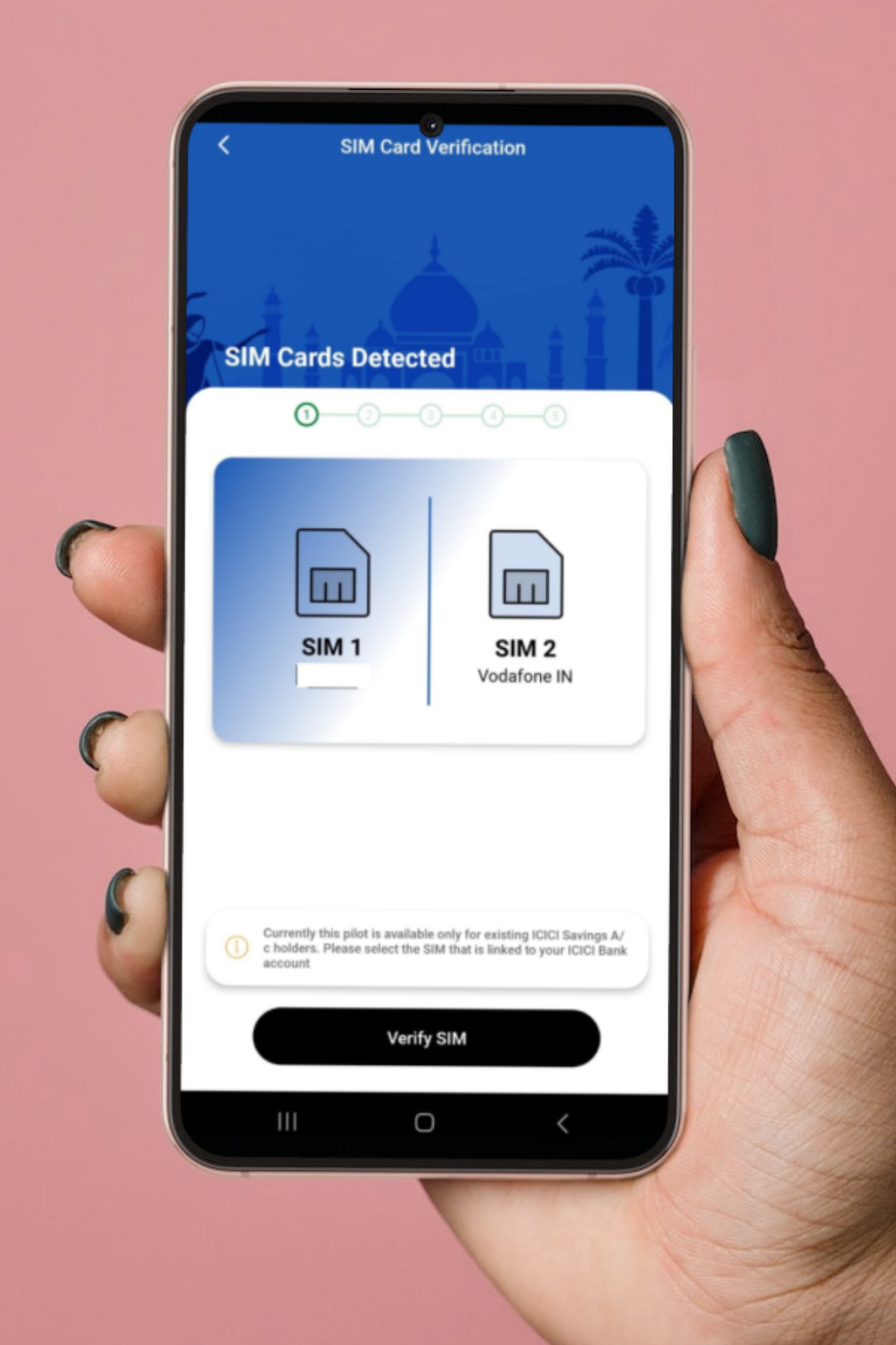

e) Select the sim slot, which is registered with your bank account and thereafter click on ‘Verify Sim’

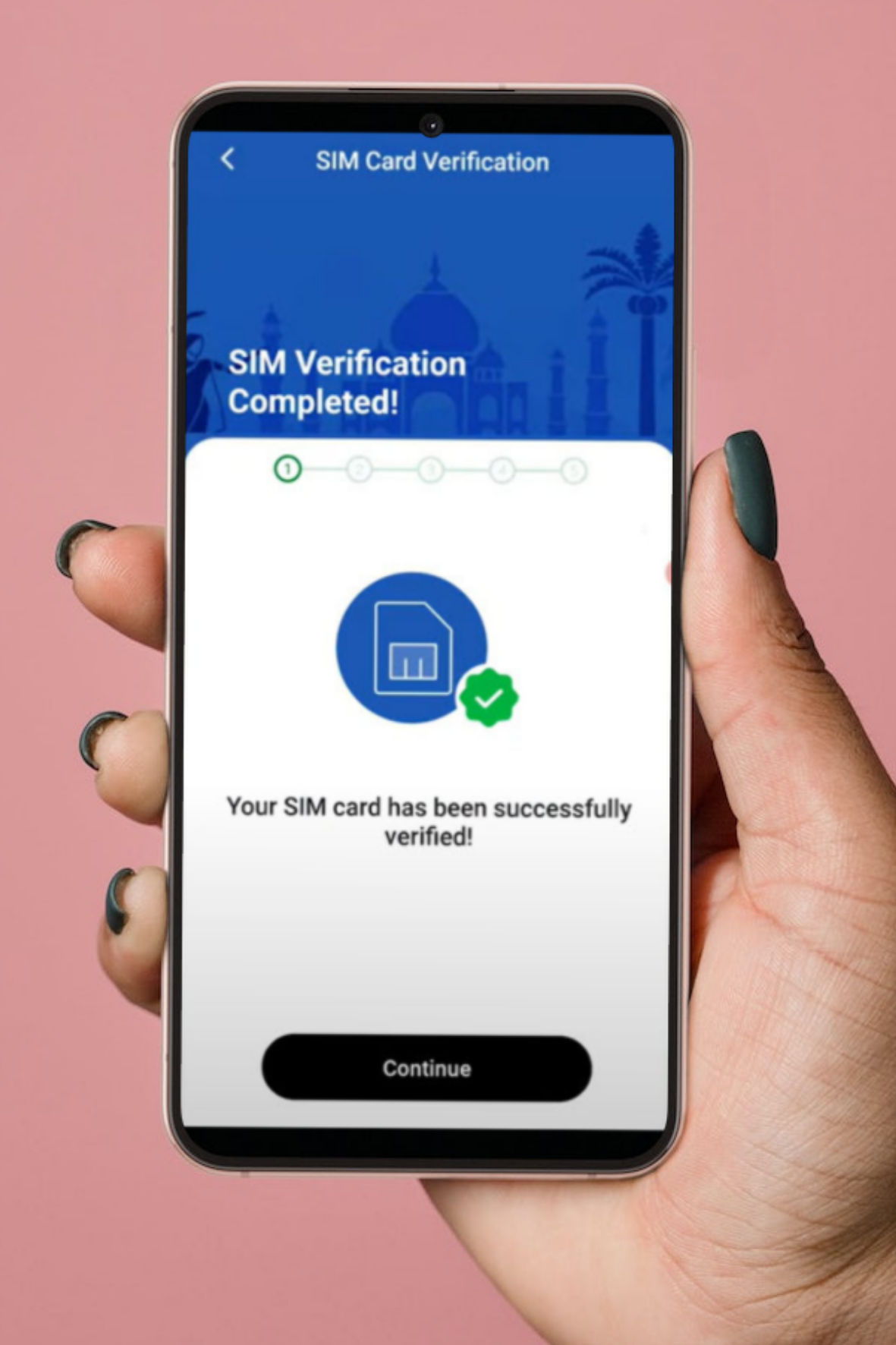

f) The application will take some time to check the bank account registered with your sim card. On successful validation of the sim card, the e-Rupee CBDC application will show you the success message.

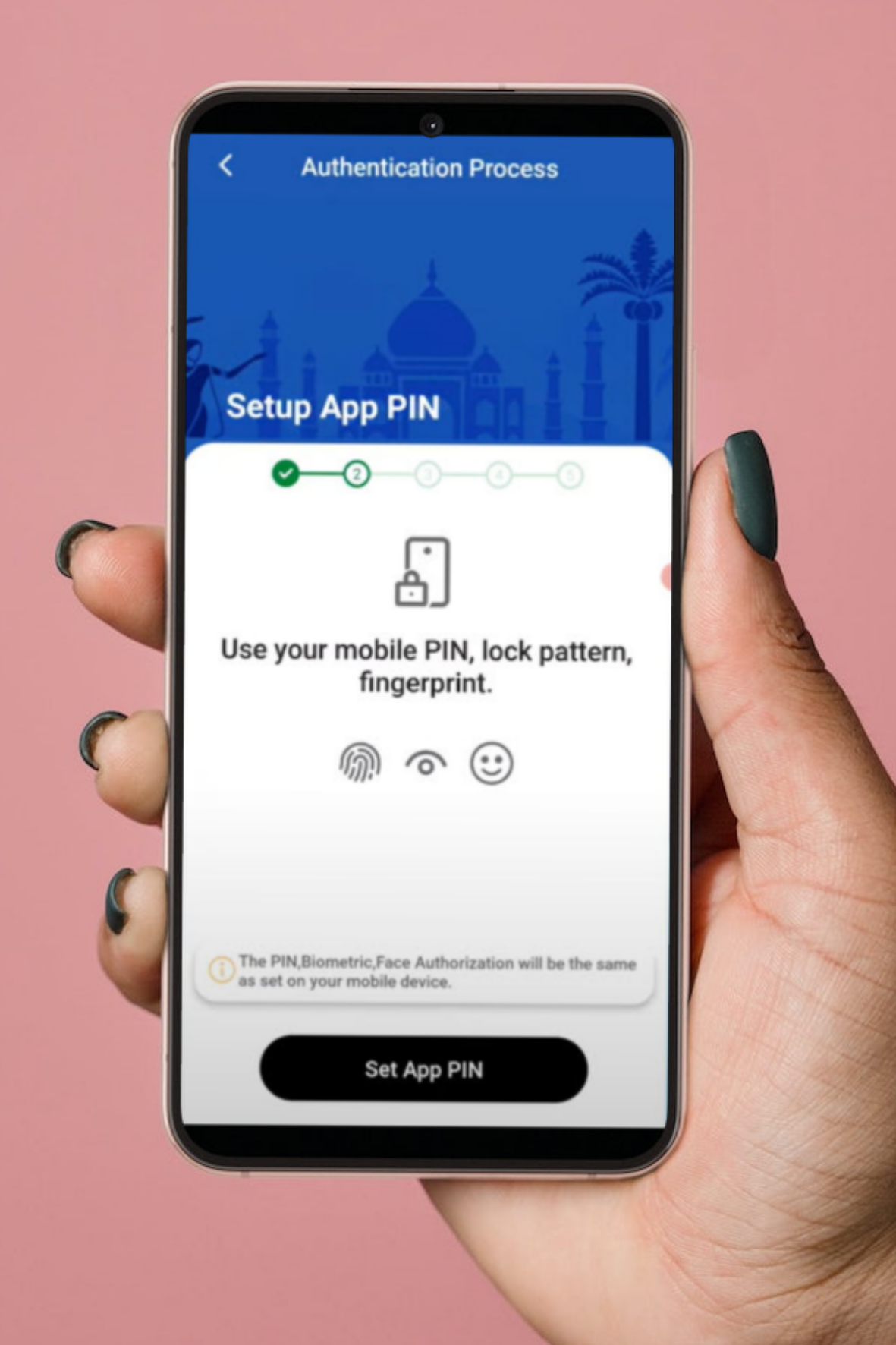

g) To make the e-Rupee application secure, setup a security pattern or a pin in the next step.

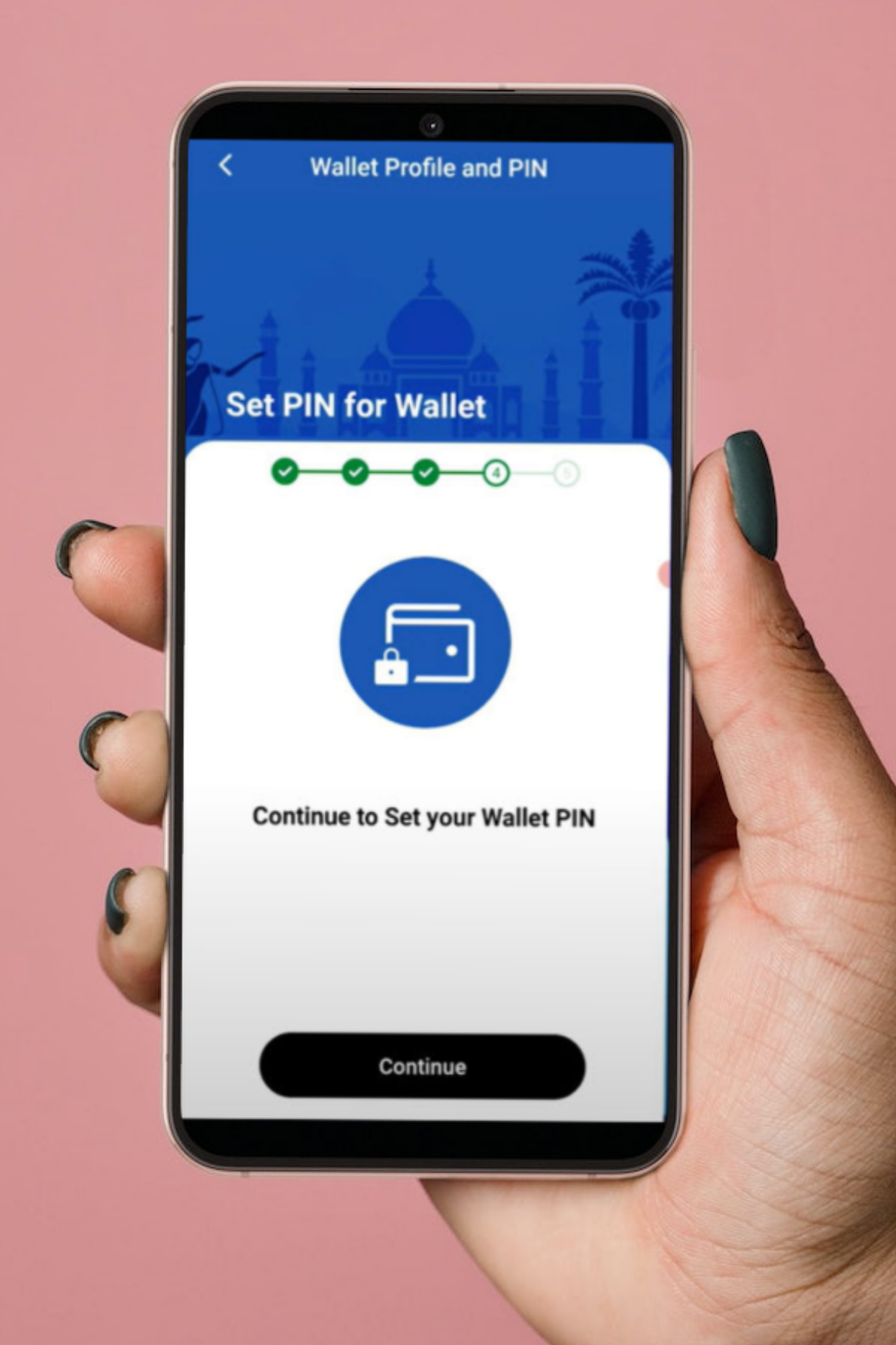

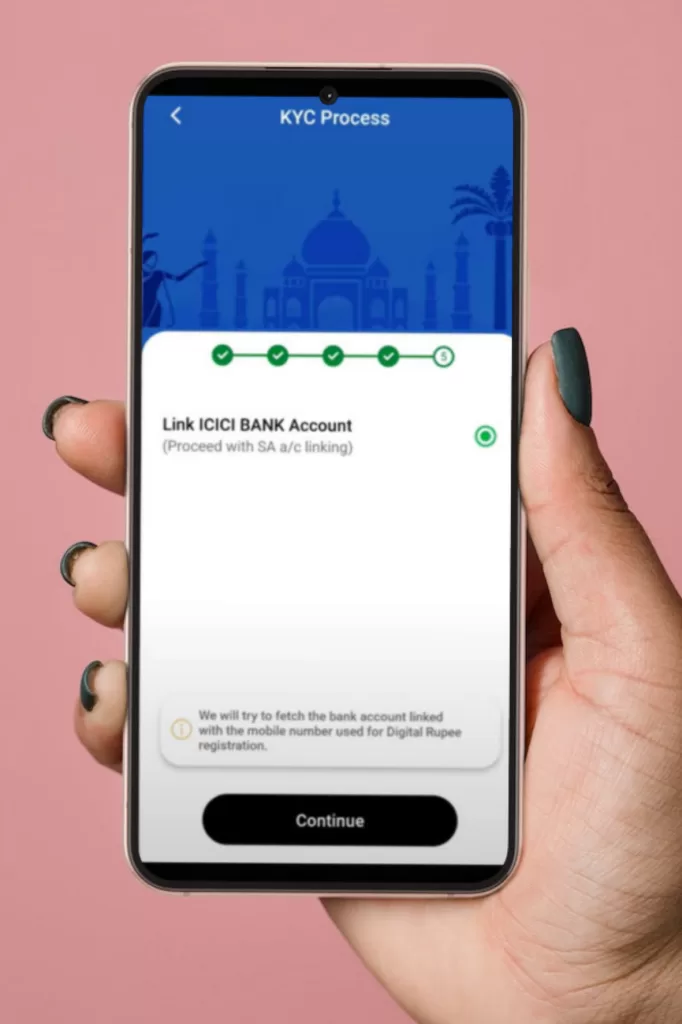

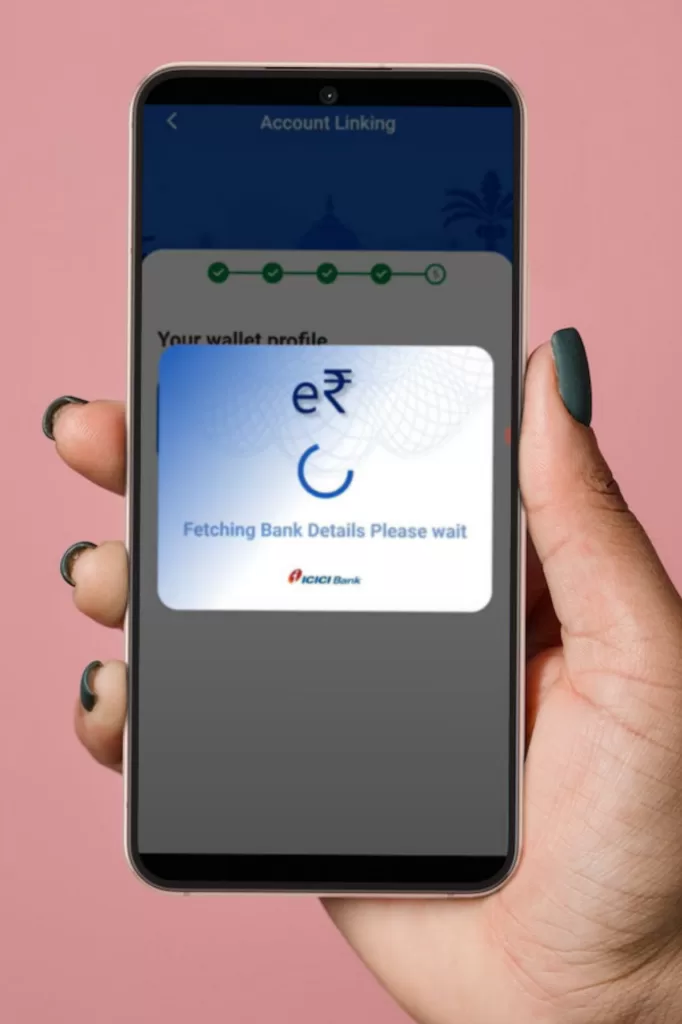

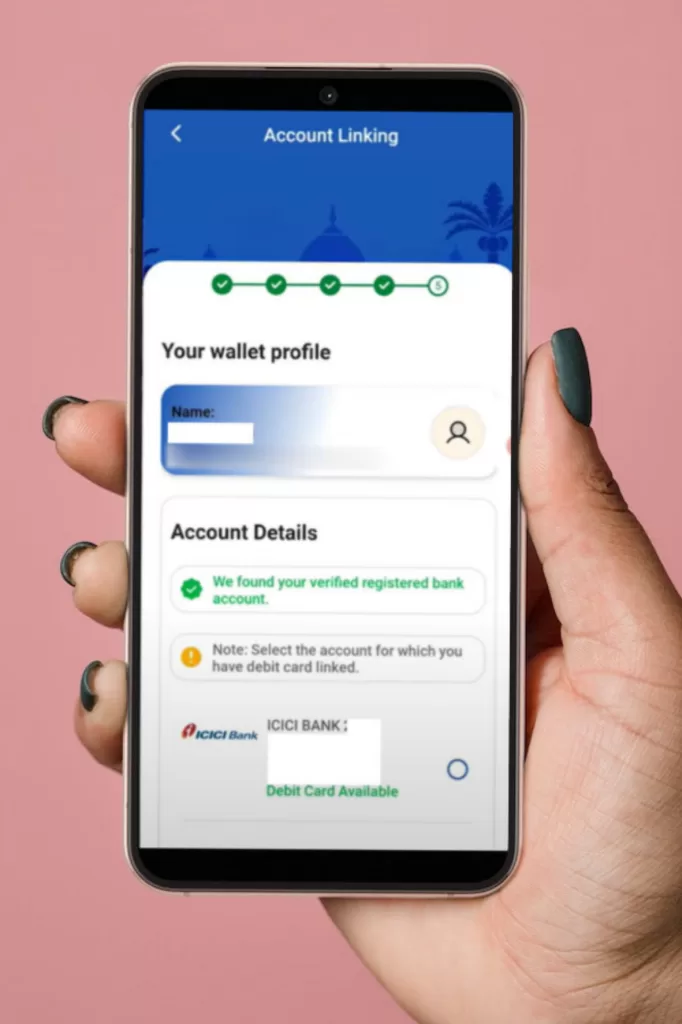

h) Once the security pin is set, you can now link your savings account number to the e-Rupee CBDC application. This account number is linked to the sim card you selected in step e.

I) Once the bank account is linked, (ICICI in this example), load the money from your account into the e-Rupee CBDC wallet.

Loading e-Rupee CBDC in the application

The extraordinary feature about the application is that you can mention the currency denomination in which you want the money to be made available in your e-Rupee CBDC application while transferring money from your savings account to this application.

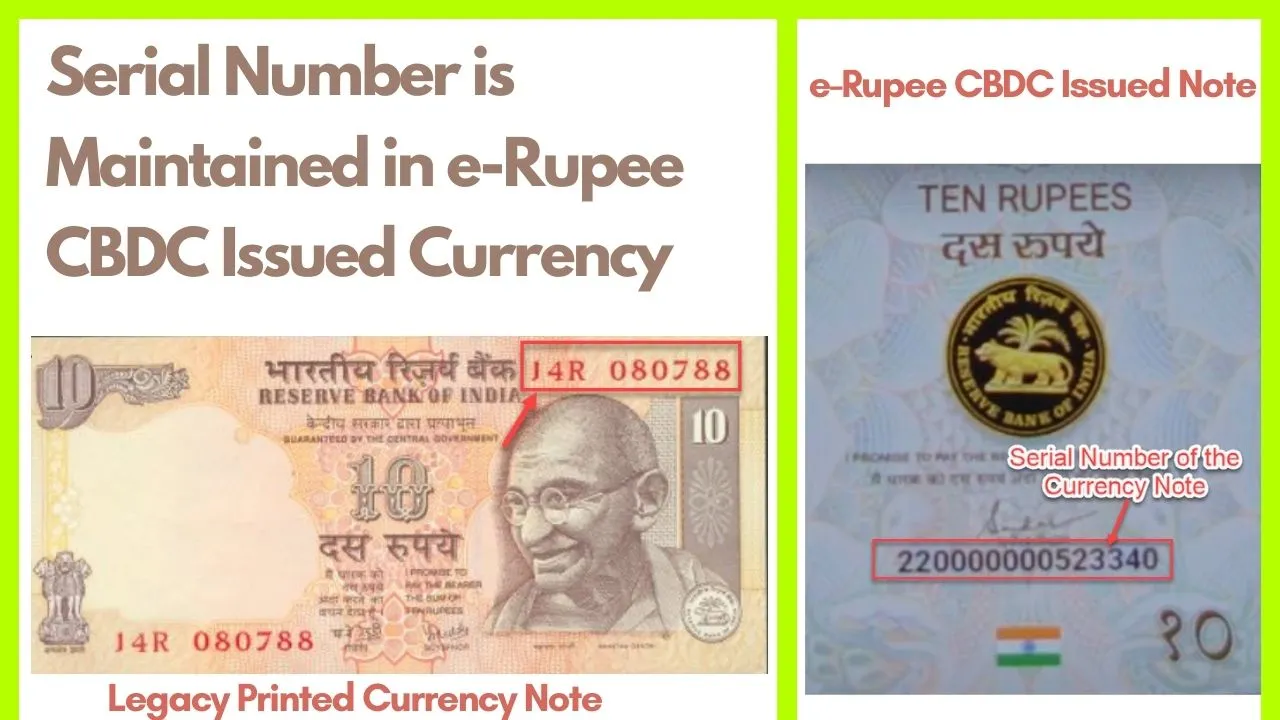

When the CBDC currency is loaded in your e-Rupee application, a unique serial number is assigned to the digital currency note, like the serial number, one would see on a paper currency note.

How and Where to Use e-Rupee CBDC?

It is quite easy to use e-Rupee CBDC application. Once the CBDC currency is loaded in your wallet, you can transfer the amount (peer-to-peer or to the merchant) by either entering the recipient’s phone number or the merchant’s QR code.

Transferring e-Rupee CBDC to Peers or Merchants

As of now, merchants are listed on invite only basis from the banks however as and when the testing phase of the CBDC is over, everyone shall be able to register on the e-Rupee CBDC application. A list of merchants5https://www.icicibank.com/custom-merchant-finder/merchant accepting CBDC payments can be found on the bank’s website.

Is e-Rupee CBDC Going to Replace UPI?

The idea behind launching e-Rupee CBDC is not to replace UPI , rather these 2 technologies can co-exist. UPI shall still be used to load or unload the money from your bank account to e-Rupee CBDC application.

e-Rupee CBDC adoption shall help the government reduce the cost of printing paper currency notes, gradually deplete its supply from the market, and rely solely on the e-Rupee CBDC-issued notes. Further, since e-Rupee CBDC technology is built on blockchain, it brings in an additional layer of security and makes hacking quite difficult. Further, in the absence of internet connectivity, e-Rupee CBDC has the capability to complete the transaction offline between the sender and recipient.

Are there any Transaction Charges for Using e-Rupee CBDC Application?

Since the intent of the e-Rupee CBDC technology is to replace the physical currency notes from circulation, therefore the transactions are kept free of charge both for the sender and the recipients. This will help in increasing the adoption of the technology amongst the masses.

What Happens to the e-Rupee CBDC Wallet if the Phone is Lost/Damaged?

There is no need to worry about the loss of phone. Since it is mandatory to set a security pin while registering the application, therefore the thief can’t access your e-Rupee CBDC wallet. Further, on your new phone, you can recover your wallet by following the registration steps mentioned above and all your loaded CBDC currency notes will be recovered easily.

References