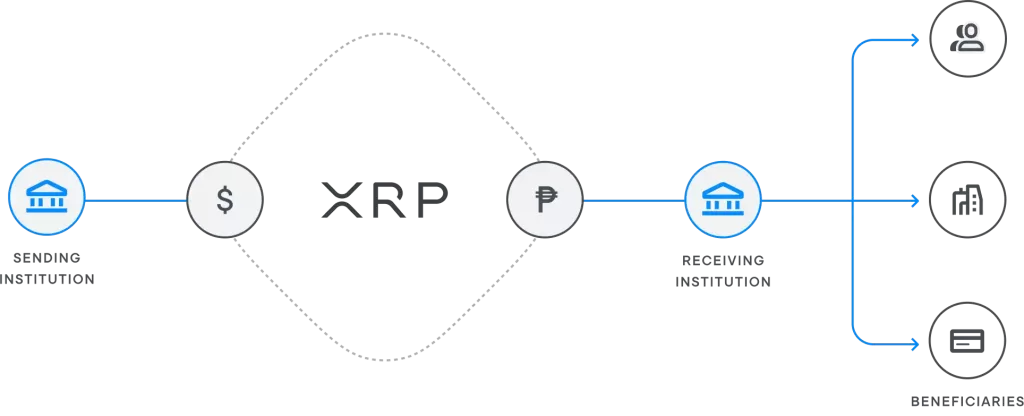

Ripple’s On Demand Liquidity, also known as ODL is an innovative solution to streamline and reduce the cost and time required to execute and complete a cross-border payment in real time1Cross border-payments solution for settlements. Ripple. (n.d.). https://ripple.com/solutions/cross-border-payments/. ODL makes use of XRP, Ripple’s cryptocurrency, as a bridge currency for converting the sender’s fiat currency into the receiver’s fiat currency. ODL was previously branded as Xcurrent or XRapid.

Explain On Demand Liquidity (ODL) with an Example

Let’s say, a sender wants to remit US Dollars to his/her family back in Mexico. The sender goes to a banking institution/exchange that uses Ripple Net and asks to remit US dollars so that his/her family back in Mexico can receive Mexican pesos.

To start with, the banker queries the using a software interface (XCurrent), for the exchange rate for US Dollars > XRP > Mexican Pesos and asks for the confirmation for the sender. On confirmation, the FX rate gets locked for the transaction. The transaction initiates with the KYC verification message (which takes a fraction of a second) and on successful verification, the US Dollars get converted into Mexican Pesos and deposited into the beneficiary’s bank account using Ripple’s ODL (On Demand Liquidity). The ODL, helps in providing liquidity to convert US Dollars to XRP and thereby XRP to Mexican Peso.

Watch the video below to visualize how cross-border payments take place using XCurrent and XRapid/ODL within a fraction of seconds.

What Problem is On Demand Liquidity (ODL) Solving for Banks, Exchanges and Institutions?

Following are some of the reasons, why banks and institutions like Ripple’s ODL solutions:-

1. Liquidity

Problem Statement

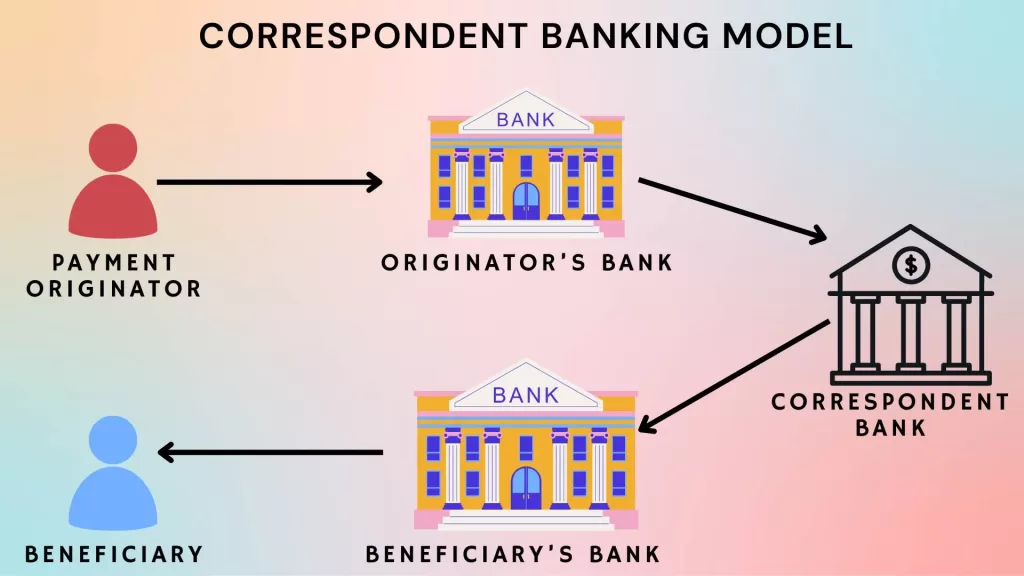

Cross-border payments currently happen via correspondent banking. Let’s understand what a correspondent banking model is.

Bank A in the USA wants to transfer $5000 to Bank B in Mexico. To complete the transfer, a third bank/liquidity hub is required in the middle that holds both US Dollars as well as Mexican Peso. This third bank is referred to as the correspondent bank.

When the transaction initiates, Bank A notifies the correspondent banks to release $5000. Thereby the correspondent bank unlocks the $5000 from Bank A Nostro’s account, converts it to an equivalent Mexican Peso, and deposits it into Bank B Vostro’s Account. Upon receiving the confirmation, Bank B funds the Mexican Peso in the beneficiary’s account.

After completing the transaction, the correspondent bank invoices Bank A for the FX cost.

Both Bank A and Bank B are required to deposit trillions of dollars in the Nostro Account with the correspondent banks in advance to facilitate cross-border payments. There is a threshold amount set by the correspondent banks for the participating banks to maintain the funds. The banks therefore always have a huge capital trapped with the correspondent banks which affects the liquidity of the banks to serve their day-to-day customers.

Ripple’s Solution – XRapid/ODL

XRapid or On Demand Liquidity (ODL) helps banks (Bank A and Bank B in this example) do away with the need to deposit trillions of dollars with the correspondent banks. This helps the bank to use the capital for growing its business and therefore the banks love ODL.

Let’s understand how:-

When a Bank/Exchange, wants to make a transfer for it’s client, it shall ping XCurrent for the exchange rate. Once the client agrees to transfer at the mentioned exchange rate, the bank/exchange proceeds with the transfer. The XRP held in the On Demand Liquidity HUB, by a third-party organization, receives the request as well as the amount to be transferred from the bank/exchange. The ODL converts the received amount into equivalent XRP and thereafter converts these XRP’s into the destination payment currency and finally deposits it in the beneficiary account. The ODL organization thereafter invoices the Bank/Exchange for the FX cost and service charges.

Since in this model, ODL maintains the XRP liquidity (required for converting the currency conversion), the concept of Nostro and Vostro accounts becomes redundant. This model therefore helps the banks get back their trapped trillions of dollars as liquid assets in the balance sheet and thereby make the bank healthier.

2. Use Now Pay Later

Continuing with the discussion, the banks do not need to maintain funds in Nostro and Vostro accounts. Furthermore, the banks while processing the cross-border payments, do not need to pay the FX cost to the ODL organizations in advance. The model works on the concept of ‘Use Now Pay Later’. The Banks/Exchanges are invoiced for the FX cost incurred by the ODL after a week.

This means that the banks not only get back their trapped capital with the correspondent banks but also get an extra 7 days of working capital in their balance sheet, since they need to pay the FX cost after a week of the actual cross border transaction date.

3. Fast and Cost Effective both for Banks as well as Customers

Cross Border Payment using the correspondent banking model takes 3-4 days on average. This means that while processing the payments, the banks/exchanges and the correspondent banks take the risk of currency price fluctuation. The risk of fluctuation is passed on to the consumer in terms of heavy transaction fees.

Ripple’s technology involving ODL, helps execute the transaction within 3 seconds. This eliminates the risk of currency fluctuation (since the transaction is completed in a fraction of seconds) and also helps pass on the benefit of lower transaction fees to the customer.

4. Less Spending on Customer Support by Banks/Exchanges

Currently, since the time taken to complete the transaction cost is quite high (3-4 days), the number of customer support calls landing on to bank’s/exchange’s call center number is quite high. Most of the calls are for knowing the transaction’s status and tracing the cross-border transaction for its status.

This requires banks and exchanges to budget a considerable portion for the customer support staff. With the ODL solution, since the transaction completes in a fraction of a second, the support calls are reduced drastically.

How Will On-Demand Liquidity and Ripple Net Increase the Price of XRP?

Let’s understand, how the price of XRP will increase with the help of On Demand Liquidity – ODL and Ripple Net.

With an increase in adoption of the Ripple Net (Inter-ledger XRP platform), the banks will start realizing the ease in executing cross-border transactions. Furthermore, to make cross-border payments cost-effective, adoption of On Demand Liquidity – ODL will increase.

As ODL corridors (presence of On Demand Liquidity – ODL between 2 countries) go live, transactions via the ODL will increase. This will put pressure on the ODL organizations to maintain an increased amount of XRP liquidity which will create more demand in the market. Furthermore, each transaction, using XRP as a bridge currency, burns a few XRPs. This means that the number of XRPs are eventually decreasing.

Since the supply of the XRP is limited, the increase in demand for XRP will push up the price of the XRP exponentially to meet the demand for the cross-border transaction.

Let’s understand with the help of an example. An ODL holds, 1 million XRP and the bank/exchange is required to move 1 million dollars. Assume 1 Dollar = 1 XRP. To move 1 million dollars, the entire liquidity of 1 million XRP will be locked against one transaction. This means that no other transaction can be performed via the ODL during the span of 3 seconds.

However, let’s assume that 1 XRP = $10,000. This means that to transfer 1 Million Dollars, only 100 XRPs will be used. This will help ODL maintain enough liquidity for the upcoming cross-border transactions.

Tracking the XRP transaction volume and XRP burn rate, gives an idea of a gradual increase in ODL adoption across the world.

Further, with the Central Bank Digital Currencies (CBDC) getting launched, the need for bridge currency such as XRP will increase, especially for wholesale payments. This will give another boost to an increase in demand for the XRP from institutional players.

To conclude, as the volume of transactions utilizing XRP as a bridge currency increases, so will the demand, and therefore the price of the XRP will eventually be pushed to a higher number.

References