Stablecoin, as the name suggests, is a cryptocurrency built on a blockchain ledger with a stable monetary value. Stablecoin inherits a stable currency value as it is pegged/set at a fixed exchange rate with a particular currency, generally US Dollar or a commodity like gold or any financial instrument. The non-volatile nature of Stablecoin makes it an important coin for exchanging (buying/selling) various digital assets like Bitcoin, Ethereum, XRP, etc.

What is the Size of the Stablecoin Market Globally?

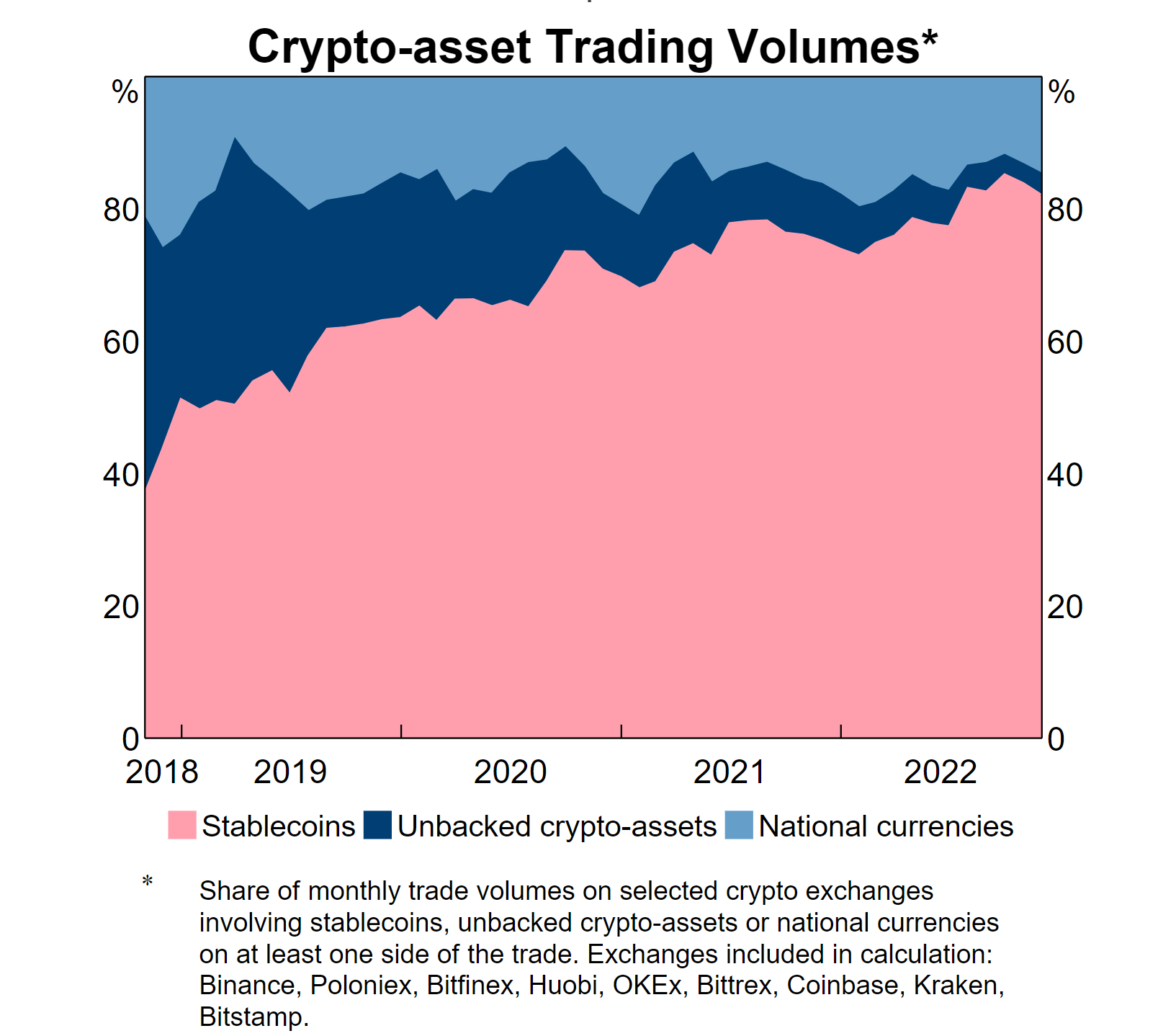

As per the latest report by the Reserve Bank of Australia1Cameron, Eleanor, Nick, & Peter. (2022, December 8). Stablecoins: Market developments, risks and regulation: Bulletin – December 2022. Reserve Bank of Australia. Retrieved February 8, 2023, from https://www.rba.gov.au/publications/bulletin/2022/dec/stablecoins-market-developments-risks-and-regulation.html, the global value of stablecoins as of April 2022, has touched US $185 Billion as compared to US $30 Billion in the first quarter of 2021, which is a massive increase of more than 500 % in just a year. Further, looking at the percentage trading volume share of stablecoins in the graph below, it ought to be taken seriously! Further, because of the excessive trading volume of stablecoins, the President’s office in the US had to issue a crypto executive order wherein plans to tackle the parallel growing financial market, were to be explored.

Reasons for Exponential Increase in Stablecoin Adoption Rate

Let’s try to analyze why stablecoins are so widely used:

1) Stable Value

The stable value of the stablecoin encourages individuals to convert their fiat currency into stablecoin and store it in their digital wallet, rather than keeping it in their bank account.

2) Instant Cross Border Transfer

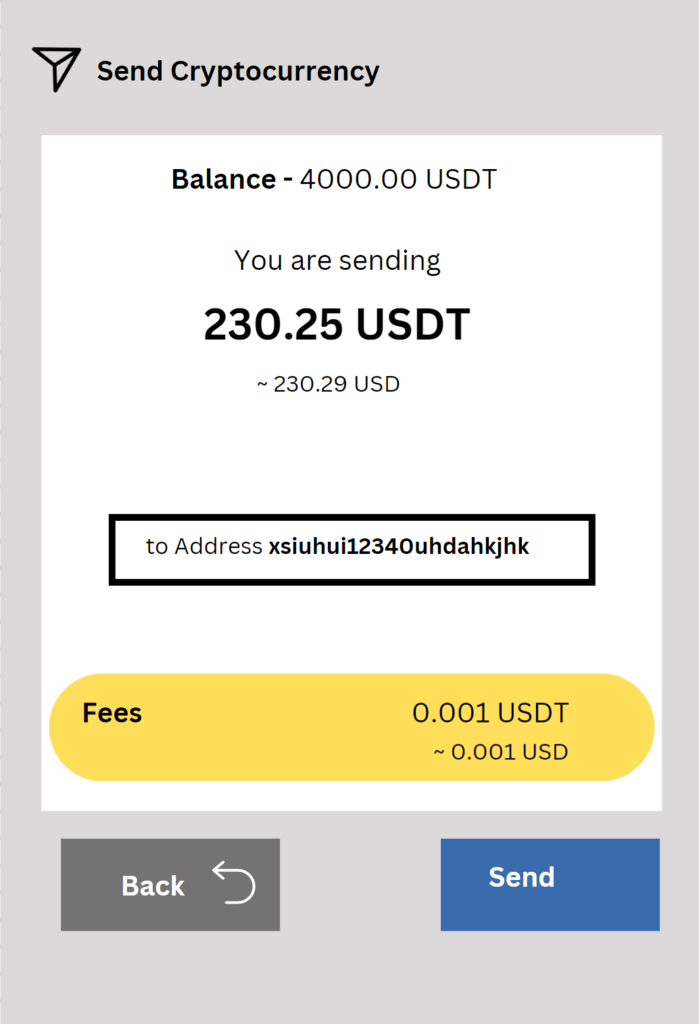

Stablecoin can be used to make cross border payments, instantaneously, at a negligible cost. For example, you have a friend/family sitting in a distant country and you need to transfer some money to him/her. One way is to go through the traditional route of bank transfer, which currently takes up to 3 business days, or convert the currency into Stablecoin, like USDT and send it to his/her digital wallet which can thereafter be converted into cash.

Note: – Since the cross-border payments using stablecoins, are increasing year on year, government and traditional banks are working on regulations and policies to regularize it2Toomey introduces legislation to guide future Stablecoin Regulation. United States Committee on Banking, Housing, and Urban Affairs. (2022, December 21). Retrieved February 10, 2023, from https://www.banking.senate.gov/newsroom/minority/toomey-introduces-legislation-to-guide-future-stablecoin-regulation.

3. Increase in the Number of Bank Failures

Money deposited in the bank account is the liability of the bank. If a bank goes bankrupt, it shall not be possible for the bank to return the depositor’s money, and thereby individuals can end up losing their whole life’s savings. However, money kept as stablecoins shall remain in the custody of the individual and will no longer be a liability of the bank.

4. Bridge Currency Between Two Investments

Crypto traders, buy and sell crypto assets, using stablecoins like USDT or USDC. After selling a crypto asset, the crypto trader might want to hold the money for some time and then take another buy position. During the interval, between two trades, the trader feels more comfortable holding the money as stablecoins rather than in fiat currency. This is due to the fact that stablecoins have stable value as compared to the fiat currency.

How is Stablecoin Different from Other Tokens and Assets like NFTs, Cryptocurrencies, and CBDC?

Following are the differences between Cryptocurrency, NFT, CBDCs and Stablecoin:-

| CRYPTOCURRENCY | NFT | CBDC | STABLECOIN |

|---|---|---|---|

| 1) What is Cryptocurrency? Cryptocurrencies are tokens issued on a blockchain and are available for trading in crypto exchanges. | 1) What is NFT? NFTs or Non-Fungible Tokens are digital assets launched on a blockchain ledger. Even though NFT is present on a blockchain ledger, it’s not a cryptocurrency or a stablecoin because of the nature of its trade. | 1) What is CBDC? CBDC or Central Bank Digital Currency is a token issued by the Reserve Bank/Federal Reserve of a Country. | 1) What is Stablecoin? Stablecoins are tokens issued by financial institutions (generally private institutions) that are stable in value. |

| 2) Volatility? Highly volatile in nature. The majority of cryptocurrencies generally rise or fall in value because of market speculations. | 2) Volatility? Less volatile in nature. The seller can set the price of the NFT token and wait for the seller to buy it. | 2) Volatility? Stable value Since the CBDC is backed by the country’s digital asset, therefore its value inside the country is stable however its value shall change against other countries’ CBDC, based on the demand and supply of the currency. | 2) Volatility? Stable value Unlike, cryptocurrency, NFT, or CBDC, stablecoins are pegged to a specific fiat currency and are therefore stable in value. |

| 3) Used Case In general, most of the cryptocurrencies are based on pure market speculations, however, a few cryptocurrencies like Ripple, Stellar, Cardano, Algorand, etc. have an industrial used case. | 3) Used Case A piece of art, music, or even a real estate property can be represented as a digital token (NFT) on a blockchain. Anyone having the digital token owns that asset or in legal terms, own the intellectual property right of the asset. The NFT ecosystem is expanding its roots in various industries like healthcare, real estate, gold and financial instruments, the energy sector, etc. | 3) Used Case CBDC is backed by the assets of the Reserve Bank/Federal Reserve and therefore can be converted, one to one, with the fiat currency. CBDC can be transacted both offline and online. and can be used for purchasing goods and services. A few examples of CBDC include e-Rupee, Digital Ruble, Sand Dollar. | 3) Used Case Because of the stable value of stablecoin, it is used as trading pair with cryptocurrencies and NFTs. Further, it is used in cross-border payments, and to store money by converting fiat into stablecoin. |

How Does Stablecoin Work?

In general, a stablecoin is pegged to a currency like US Dollar which is used as a reference point to maintain a stable value. Depending upon the type of stablecoin, the way it works differs. Let’s try to analyze how different types of stablecoins work: –

1) Stablecoin as a Collateral with Fiat Currency

This is the most common type of stablecoin where the coin itself is pegged to a fiat currency like US Dollars or Euro. This means that the value of the stablecoin against the US Dollar will always remain 1:1. One such stablecoin example is USDT.

How Does it Work?

Considering, the stablecoin is pegged to US Dollars, then for every 1 stablecoin issued to the consumer/marketplace, $1 should be held in collateral, and on liquidating/destroying the same stablecoin, the $1 in collateral needs to be released to the consumer to maintain the pegged value against the US Dollars.

Analysis Of this Model

This model is quite centralized in nature and functions just like a bank. The issuer of the stablecoin is responsible for maintaining the deposits of the pegged currency against the issued stablecoin. Regular audits and maintaining transparency by the issuer are quite important, to maintain trust and confidence in the sustainability of the stablecoin. Further, the issuer also needs to be careful about the rules and regulations of the currency against which it is pegged.

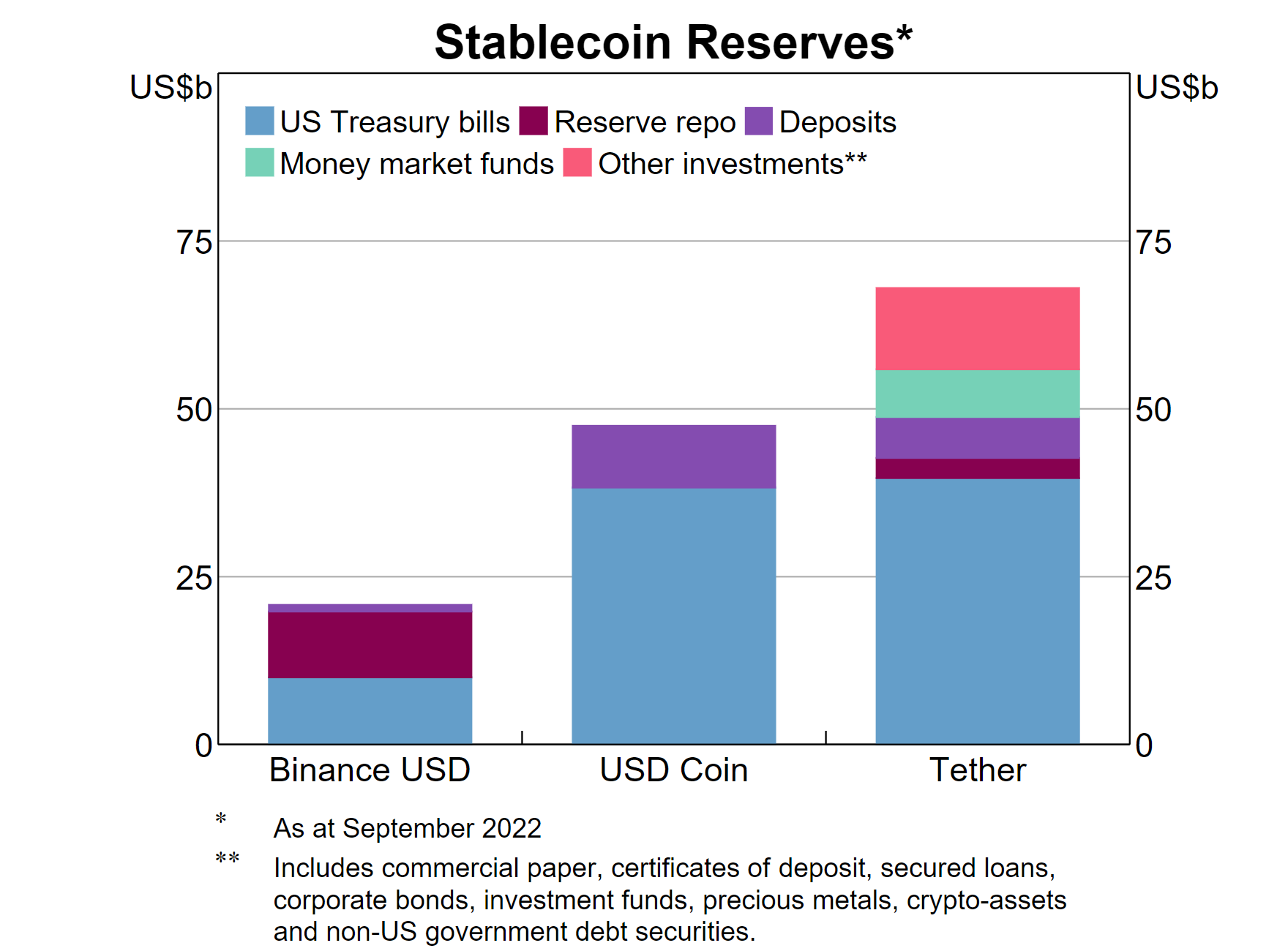

Lack of liquidity of the stablecoin against the fiat currency can result in the collapse of the coin and end up sinking the investments made by individuals or institutions. As of September 2022, the following are the reserve holdings by fiat-backed stablecoins

2) Stablecoin as a Collateral with Cryptocurrency

This is another type of stablecoin that is backed by cryptocurrency like Ethereum or Bitcoin. The ratio of the value of the stablecoin and cryptocurrency is maintained. This thereby helps in maintaining the stable value of the coin. Examples of such coins are Wrapped Bitcoin (wBTC), bitUSD, PHP, bitCNY, etc.

How Does it Work?

Stablecoin backed by cryptocurrencies is usually launched on the Ethereum blockchain by deploying a smart contract. It helps in maintaining the stable value of the coin and also makes it as decentralized in nature.

Unlike, fiat-backed stablecoins, which can be simply traded as 1:1 with the fiat currency, crypto-backed stablecoins don’t have a similar ratio. Let’s try to understand it with an example.

Let’s say a stablecoin, which has a value of $1, is collateralized with a cryptocurrency that is highly volatile in nature. This means that for every token of stablecoin, the issuer shall have to pledge up to 200% ($3) worth of cryptocurrency to maintain its peg even in highly volatile scenarios.

Analysis Of this Model

Crypto-backed stablecoins are decentralized in nature as it deploys smart contracts on the ledger. (Smart contracts are coded programs that are designed to transact if a particular condition(s) are met). This is the reason to rely on these stablecoins as the reserves against the stablecoins are regulated by smart contracts. Further, unlike fiat-backed stablecoins, there is no issue of liquidity as the reserves against the crypto-backed stablecoins are always maintained.

3) Stablecoin without Collateral

These stablecoins are not backed by any asset however, these are still able to maintain their stable value with the help of algorithm. A few examples of algorithm-based stablecoins are Terra USD, Kowala and Carbon.

How Does it Work?

This model makes use of an algorithm on the blockchain ledger which controls the supply volume of the stablecoin to balance the demand and supply in the market. This helps in maintaining the price of the coin against a fiat currency, without having to keep reserves of any asset.

For example, let’s say the value of the stablecoin is $1. Suddenly due to market speculations, the buy orders increase for this stablecoin, leading to a potential increase in the price. In such a situation, the algorithm, shall get triggered and issue more stablecoin in the market and maintain the price to $1. Vice versa, if the value of stablecoin decreases, the algorithm will come into play and burn some of the stablecoins, to maintain its price to $1.

Analysis Of this Model

This model of stablecoin is highly decentralized in nature as the algorithm takes care of the supply and demand of the coin and thereby maintains its price. There is no central control required to control the price of the coin.

However, the sustainability of the coin highly depends on how the algorithm comes into play during volatility. A recent case of Terra, which used to burn the coin LUNA (which runs on Terra Blockchain) to maintain its price, collapsed to near zero in value. The reason for the catastrophe was found to be excessive volatility in the market fueled by individuals dumping their Tera USD to liquidate it into fiat currency.

Take Away

While the stablecoins are on the rise and are becoming popular day by day, however, the so-called stable value model failure, like the Terra Luna, has shattered the confidence of a lot of crypto enthusiasts. Stablecoin regulations are the need of the hour. The stablecoin issuers shall be mandated to have regular audits and release reports of reserves to the public on regular basis. USDC, recently started doing so and has thereby won the trust of the crypto ecosystem.

References