Wholesale CBDC is the digital version of the Central Bank money. It is used by financial institutions (that hold deposits with the central bank) to settle interbank transfers and wholesale transactions. It is envisioned to bring efficiency and stabilization to the financial ecosystem.1

Why Wholesale CBDC?

The central bank money has two legs. The first leg of central bank money is made available to the public in the form of cash or Retail CBDC whereas the other end is Wholesale CBDC.

Central bank money has always existed in the digital form and has been moving between Central Banks and financial institutions, however, there was a need felt to modernize the infrastructure to move Central Bank money efficiently. Novel technologies like Distributed Ledger Technology, Decentralized Finance Applications, and Stablecoins are budding as competition to the Central Bank money. Moving money using these new technologies is efficient, quick, cheaper, and more transparent, and therefore, there was a need to review the existing digital infrastructure of Central Bank Money to compete with the parallel monetary infrastructure getting created. This gave inception to the concept of Wholesale CBDC.2

Used Cases of Wholesale CBDC and How Does it Transact?

1) Tokenization of Financial Assets to Reduce Settlement Time

There are multiple financial assets available in the market like stocks, bonds, mutual funds, securities, equities, debt, etc. which have a complex system of settlement. These financial instruments requires nearly 2-3 days for the settlement.

Wholesale CBDC is being envisioned as a panacea to reduce the settlement time by tokenizing the assets on Distributed Ledger Technology (DLT)3.

How would it work?

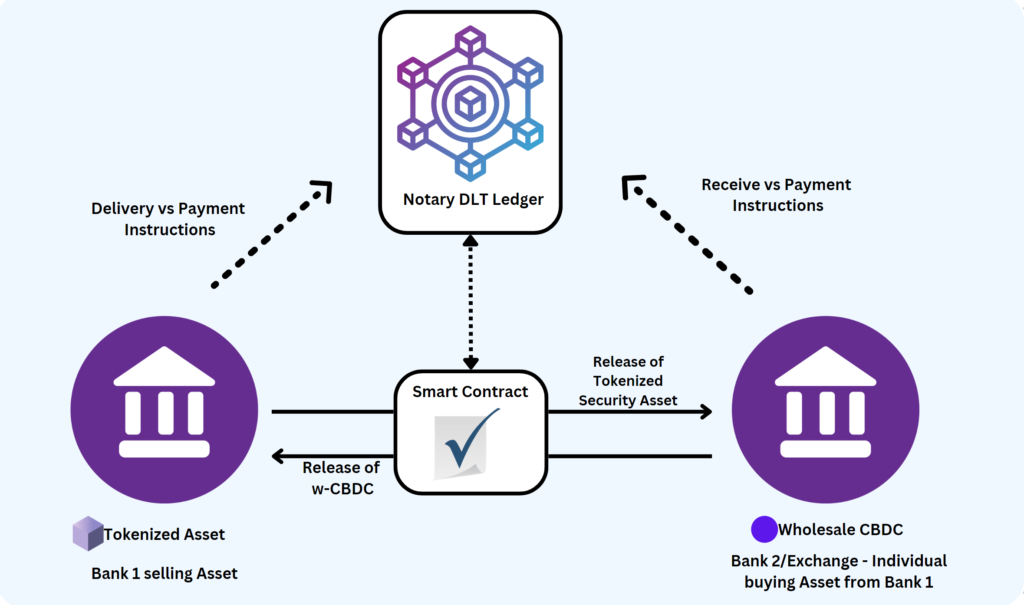

Consider a case where a stock or a bond is to be bought by an individual. These shall be present as tokenized assets on the DLT platform (managed by the Securities Exchanges of the country).

Along with tokens, there shall be smart contracts created by the exchange which are nothing but pre-programmed codes. The smart contracts are designed to automate the release of securities tokens on the receipt of payment (wholesale CBDC) as well as credit the amount in the seller’s account, on its successful sale.

So, let’s say one fine morning, you decide to buy the tokenized stock or bond. You shall, log on to the exchange with your account and place a request for the purchase.

Bank 1 (Holding tokenized stocks and bonds), on receipt of the purchase request shall create a Delivery vs Payment Instruction, which is basically a form consisting of details about the value of the tokenized stock and its quantity. The Delivery Vs Payment Instructions are updated on the ledger and are received by Bank 2/Exchange (from where you placed a request to purchase tokenized stocks and bonds).

In return Bank 2/Exchange, fills the Receive Vs Payment Instructions (a form similar to Delivery vs Payment Instruction) with details like availability of funds, account number from where to debit the amount, etc., and updates the ledger.

Once the Delivery vs Payment Instruction and Receive Vs Payment Instructions, are updated on the ledger, a match happens and the smart contract comes into play. It triggers the debit of funds in the form of wholesale CBDC from Bank2/Exchange and at the same time, releases the tokenized assets from Bank1. These transactions takes fractions of seconds to execute.

Similarly, while selling the securities purchased, by the individual, the credit of the amount (involving wholesale CBDC) using the same workflow shall happen, in a fraction of a second.

2) Cross Border Payments with Wholesale CBDC

Why Cross Border Payment with Wholesale CBDC (w-CBDC)?

Cross-border payment at the moment is quite time-consuming, inefficient, and costly. There are several intermediaries or correspondent banks involved (while doing a cross-border payment). These banks operate from 9 am to 5 pm as per their time zone. This constrains the availability of the intermediary bank to process cross border payments 24X7. Further, these banks charge a hefty transfer fee for processing the transfer. These two factors add a lot of friction in the cross border payment ecosystem.

Because of the operational challenges, and restricted banking hours, a transaction between Bank A to Bank B, can take up to 10 days, to complete. This means that a business, waiting for the payment to be released by Bank B, needs an extra 10 days of working capital, which currently is a huge problem.

With Central Banks adopting Wholesale CBDCs, present on the blockchain ledger, it shall become a lot easier to transact.

Multi CBDC (m-CBDC) Experiment To address the problem of friction in cross-border payment, a multi-CBDC experiment, named as ‘Project Dunbar’, was conducted by the Bank of International Settlement along with the Central Bank of the UAE, Bank of Thailand, People’s Bank of China, Hong Kong Monetary Authority. The prototype experiment used m-CBDC bridge, which is a multicurrency CBDC platform, used by central and commercial banks to streamline economic, financial, and regulatory activities. Another m-CBDC experiment was conducted by JP Morgan4 where Singapore Dollar CBDC and EURO CBDC were transacted on a private ledger based on Quorum

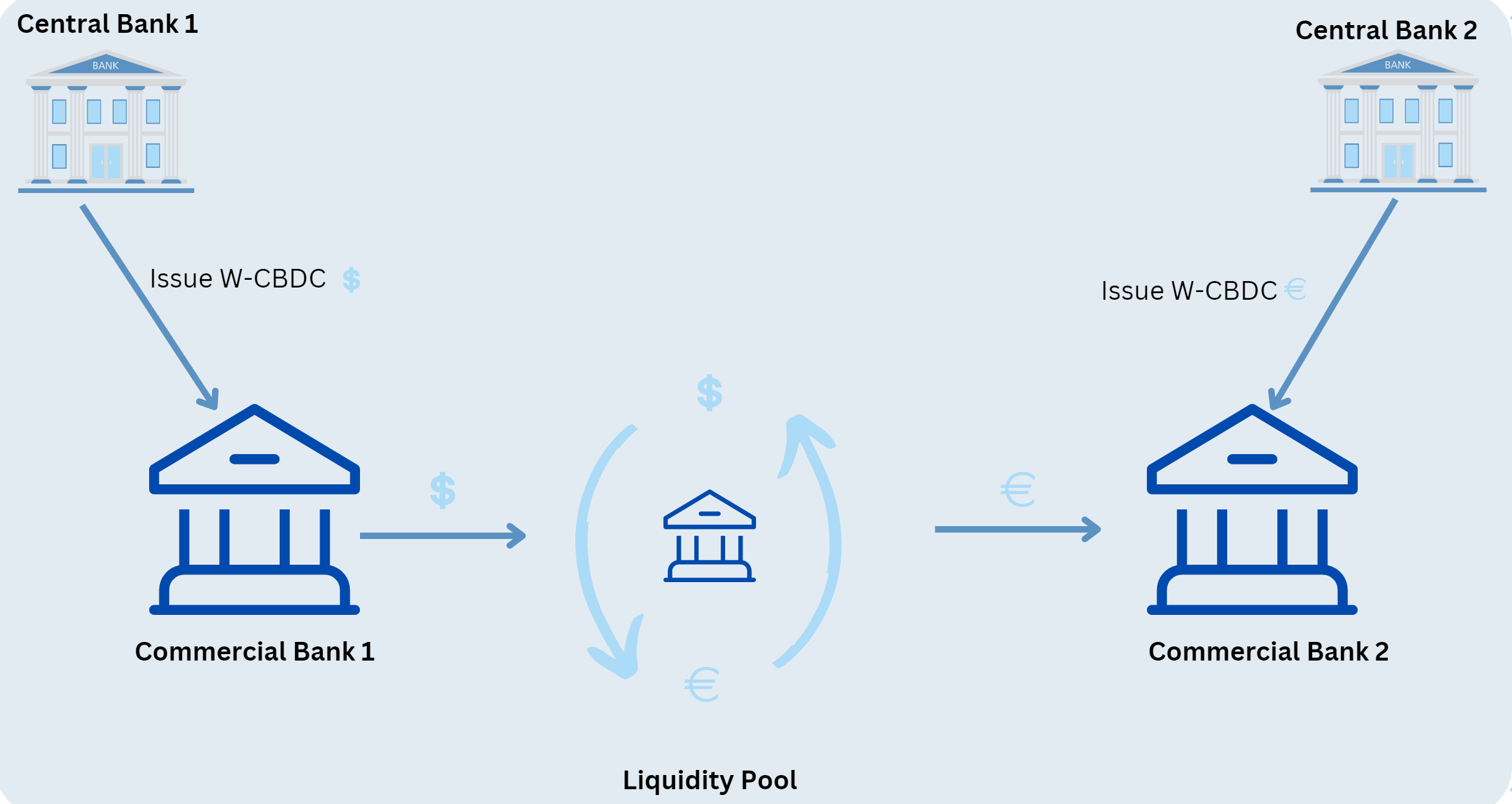

How Will Cross-Border Payment Work with w-CBDC and m-CBDC Platform?

The m-CBDC platform is a platform where Central Banks and commercial banks of various countries can transact cross-border payment, 24X7, without the correspondent banks, at fraction of the current transaction cost.

Let’s say, you as an individual want to transfer $ 10,000 to a business owner in Europe to buy goods. Following are the steps that you will need to complete to execute the transaction successfully:-

1) Add Beneficiary Details

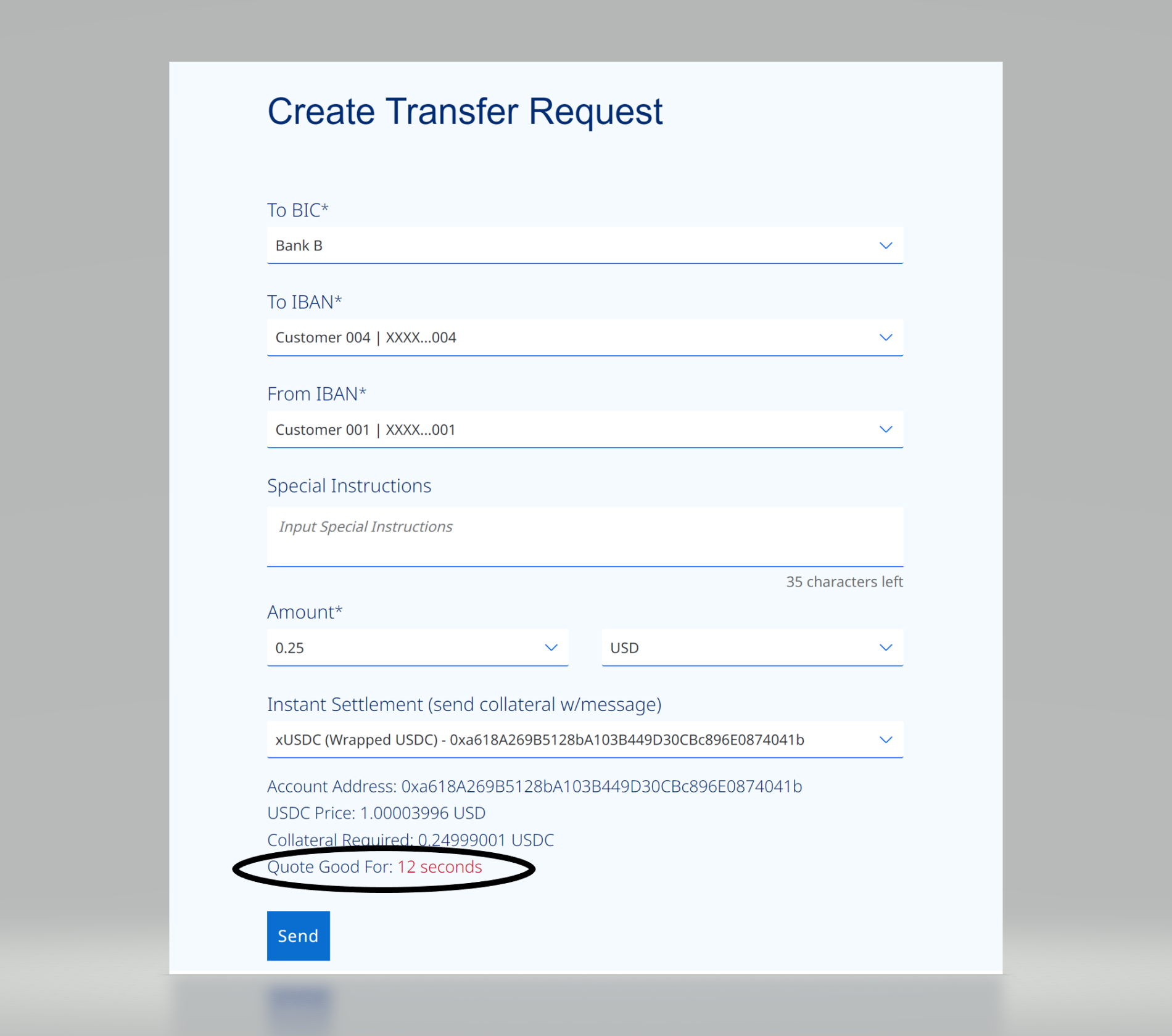

To initiate the transaction, you shall log in to your bank’s website and add the beneficiary’s details (of the merchant), present in Europe.

2) Transaction Initiation and Validation

After the beneficiary is added, you shall initiate the transaction. The transaction cost including the cost of converting Dollar to Euro by the liquidity pool shall be presented to the user for 30 seconds

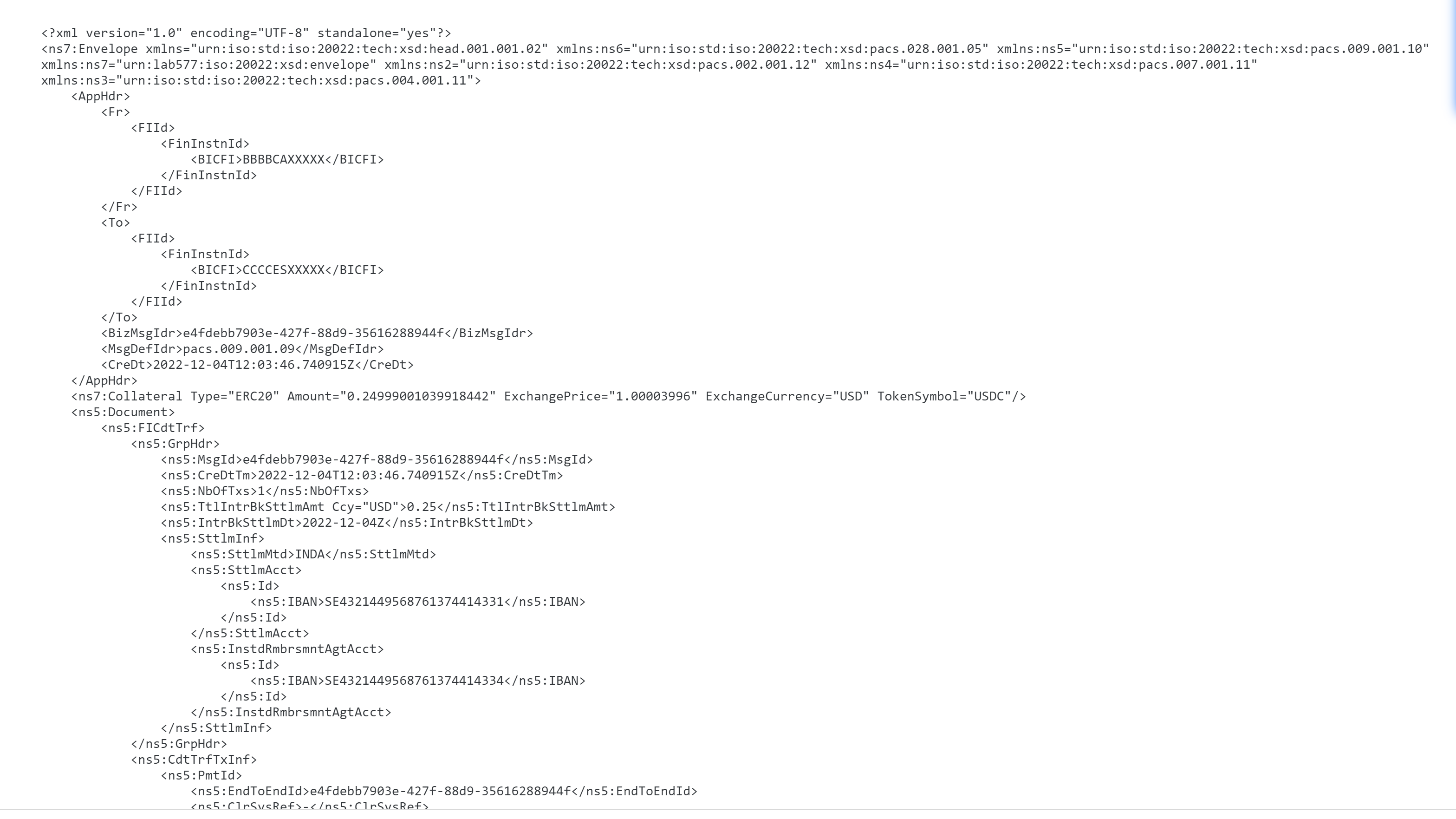

Once accepted, the transactions shall undergo validation on the private ledger network. Various aspects of the transaction are validated such as:-

a) Validity of the identity of the individual initiating the transaction and beneficiary

b) Availably and Authenticity of funds

c) KYC and AMF/CFT validation

Since the transaction occurs in ISO 20022 format, carrying out validation becomes quicker and easier. It shall be possible with ISO 20222 format, to tell at source, to the payer, based on the validation result of the transaction, if the bank shall be able to proceed with the cross-border transaction or not.

After the validation is successful, w-CBDC (wholesale CBDC) from the payer’s bank ($ in this case) is released and is presented to the liquidity pool.

3) Liquidity Pool

m-CBDC bridge replaces Nostro, Vostro Accounts, and correspondent banks, with liquidity pools.

The liquidity pool is defined as a hub of pre-collateralized currency. Payment made in one currency with wholesale CBDC, shall be exchanged here as per the existing FX rate and thereby the converted currency shall be released to the beneficiary bank. In the example shared, payment made in wholesale CBDC dollars shall be converted to its equivalent Euro wholesale CBDC via a liquidity pool.

Who will maintain Liquidity Pool? a) Financial institutions chosen by SWIFT or Bank of International Settlements shall fund liquidity pools with the currencies required for an exchange. In return, these financial institutions can charge a transaction amount to the bank. For example in the m-CBDC experiment, the Bank of France was charged 10 basis points, by the liquidity pool, on the amount that was to be transferred5. b) The second way to maintain the liquidity pool is by bringing the m-CBDC bridge on Ripple’s On Demand Liquidity Platform6.

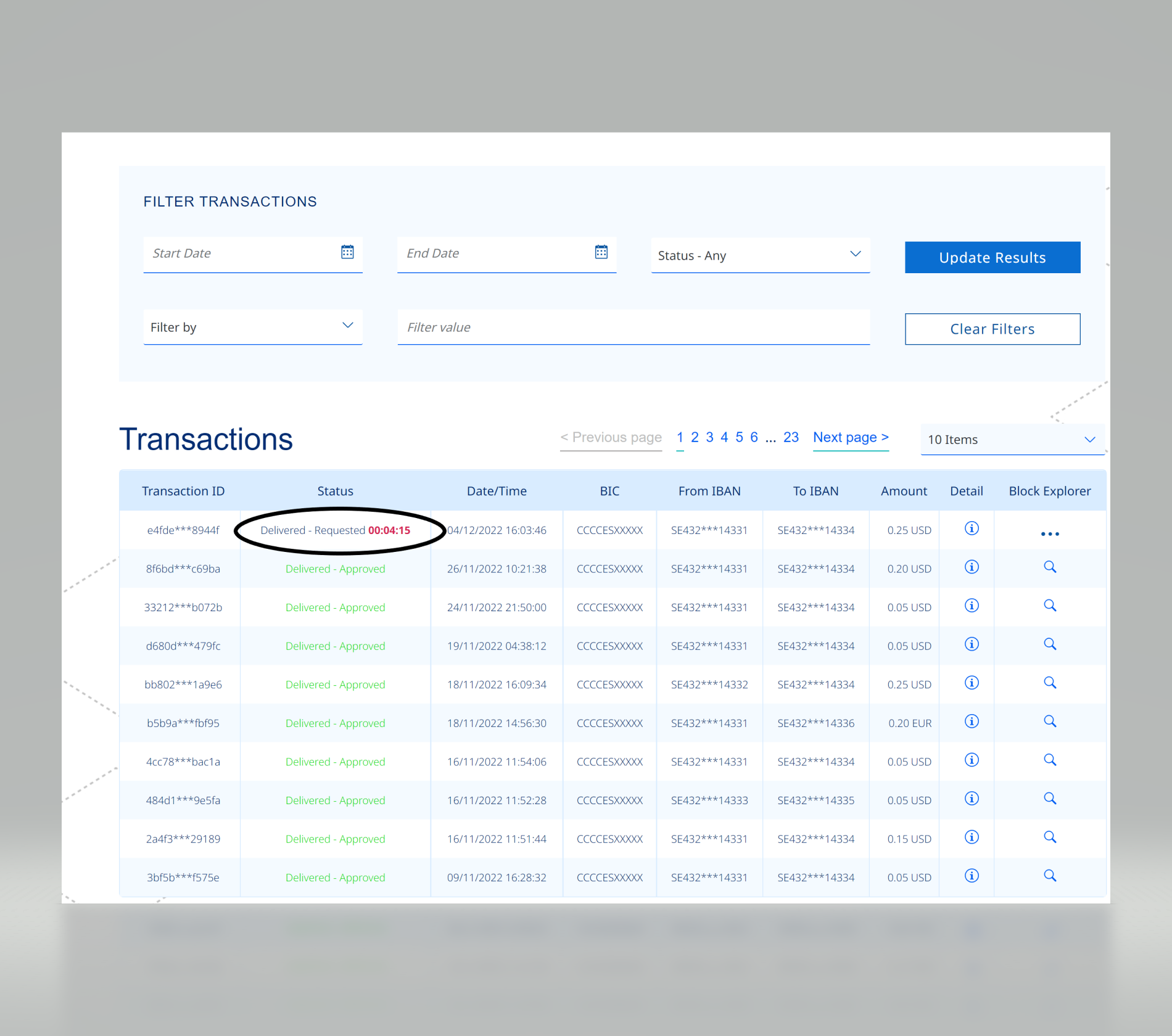

4) Ledger Update

Once the w-CBDC ($) is converted into w-CBDC (€) with the help of a liquidity pool, the ledger is updated and the amount in Euros is credited to the beneficiary’s account.

Since, the smart contracts are deployed in the m-CBDC bridge platform, Validation of transaction, payment debit from payer’s account, conversion of the currency in liquidity pool and credit of the beneficiary account happen automatically without any human intervention. This makes cross border transaction using w-CBDC almost instantaneous, cheaper, and available 24X7.

Summary

This is just the start. As and when, the private players join the w-CBDC ecosystem, the number of used cases are only going to increase, which shall make the existing financial ecosystem more efficient and cost-effective.

References

- Bank for International Settlements. (n.d.). Retrieved February 4, 2023, from https://www.bis.org/publ/othp33.pdf

- Wholesale Central Bank digital currency experiments … – banque de france. (n.d.). Retrieved February 4, 2023, from https://www.banque-france.fr/sites/default/files/media/2021/11/09/rapport_mnbc_0.pdf

- Wholesale CBDC. EUR. (n.d.). Retrieved February 4, 2023, from https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32020R0878

- Liquidity management in a multi-currency corridor network. J.P. Morgan. (n.d.). Retrieved February 4, 2023, from https://www.jpmorgan.com/technology/mCBDC

- Wholesale Central Bank digital currency experiments … – banque de france. (n.d.). Retrieved February 4, 2023, from https://www.banque-france.fr/sites/default/files/media/2021/11/09/rapport_mnbc_0.pdf

- Ripple, T. (2022, November 16). The evolution of on-demand liquidity: Corporate adoption of crypto-enabled payments. Ripple. Retrieved February 4, 2023, from https://ripple.com/insights/the-evolution-of-on-demand-liquidity-corporate-adoption-of-crypto-enabled-payments/