XRP is a cryptocurrency token created by Ripple Labs. It operates on the XRP ledger and helps facilitate transactions on the ledger. It is famously known as the ‘Banker’s Coin’ because of its famous use case i.e. Cross Border Transactions. The XRP community and the experts believe that the XRP price needs to be quite high to facilitate cross-border transactions efficiently. However, the price of XRP is low for various reasons which we shall discuss in this space. Also, we will share an analysis of when will the XRP price increase and how high it can go.

What are the Reasons for the XRP Price Volatility?

XRP is supposed to be used by banks, exchanges, and financial institutions for cross-border payments and therefore the price of the XRP coin needs to be high. However, the XRP price movement currently happens purely based on speculations and mostly follows the price movement of Bitcoin.

Let’s try to analyze the reasons preventing XRP from reaching its correct price:-

1) SEC Vs Ripple Ongoing Case

It was the time when the world was about to celebrate Christmas in 2020 and suddenly the news came out that the US Securities and Exchange Commission has charged Ripple Labs for selling XRP as unregistered securities to the public. Immediately post this news, the XRP price plummeted causing havoc amongst the XRP community and Institutions.

MoneyGram, an exchange in the US was using Ripple Net and On Demand Liquidity back in 2020. Immediately after the SEC vs Ripple case, MoneyGram (one of the biggest clients of Ripple Labs) discontinued its ties with Ripple Labs1MoneyGram’s decision to halt Ripple Partnership leaves CFO with … Wall Street Journal. (2021, February 26). https://www.wsj.com/articles/moneygrams-decision-to-halt-ripple-partnership-leaves-cfo-with-earnings-hole-11614349800. This gave another big setback to the XRP price.

The good news is that Ripple partially won the court case on 13th July 2023 (won for the allegation that XRP is a security). SEC failed to provide enough evidence to the court to prove that XRP is a security. However, the hearing on allegations of raising funds from institutional investors by distributing XRPs to them, is still going on. The schedule for the case is as follows:-

The institutions are eagerly waiting to use Ripple’s technology for cross-border payments, however, the legal case against Ripple is prohibiting them from doing so. The win, in this case, shall make the path clear for Ripple Labs and the Institutions wanting to use this technology. Bank of America, for example is waiting to work with Ripple, once the legal clarity is there in the US2Browne, R. (2023, July 18). Ripple says U.S. banks will want to use XRP cryptocurrency after partial victory in SEC Fight. CNBC. https://www.cnbc.com/2023/07/17/ripple-hopes-judge-ruling-in-sec-case-will-lead-to-us-banks-using-xrp.html.

2) Slow Adoption

While few countries like Japan, South Korea, Singapore, the United Kingdom, and Palau have realized the importance of blockchain in finance, there are a lot of major economies including the United States that are still skeptical about adopting it in the mainstream. Since Ripple Labs only ties up with the central banks and wholesale financial institutions, support from the Federal Government and Federal Banks is quite necessary for the adoption.

The good news is that, with the push from Bank of International Settlements (BIS) and the International Monetary Fund (IMF), the countries are slowly realizing the importance of shifting to the new technology or else they will be left out in the race to the new financial ecosystem.

3) Compliance and Regulations

The decision-makers sitting up the ladder are usually aged individuals who are far away from technology. Expecting them to understand blockchain for cross-border payments, is like expecting Mammoth to be alive again.

The United States, for example, has been struggling since 3 years, just to decide if cryptocurrencies fall under the regime of the Securities and Exchange or Commodity Exchange Commission.

The private sector is therefore quite conscious of staying away from Ripple Labs, because of the lack of regularity clarity. Many feel that without regularity clarity, partnering up with Ripple can invite troubles from the regulatory authorities. This is not only hurting Ripple’s business but also pushing blockchain innovation away from the United States.

4) ISO20022

Bank of International Settlement (BIS) has laid down standards termed ISO20022 for upgrading the cross-border payment messaging standard. Currently, the customer data, KYC, and compliance details are sent in an unorganized manner which causes delays in the cross-border payments.

ISO20022 standards organize this information in XML data sets. This helps in doing pre-check validation before initiating cross-border payment. It helps in avoiding unnecessary delays later during the transaction.

There is a deadline of 2025 for the banks, by BIS, to adopt the ISO20022 standard. The adoption will help Ripple, as KYC and AML validation is an event in Ripple Net before executing a cross-border payment.

5) ODL Corridors

Ripple’s On Demand Liquidity is already present in 70 payment corridors which covers approximately 55 countries3Ripple, T. (2023, November 8). Ripple transforms payments experience to unlock enterprise crypto adoption. https://ripple.com/ripple-press/ripple-transforms-payments-experience-to-unlock-enterprise-crypto-adoption/. Even though these corridors are live, the real movement of cross-border payments using XRP is yet to take mainstream adoption.

6) Retail Player’s Dominance over Wholesale Players

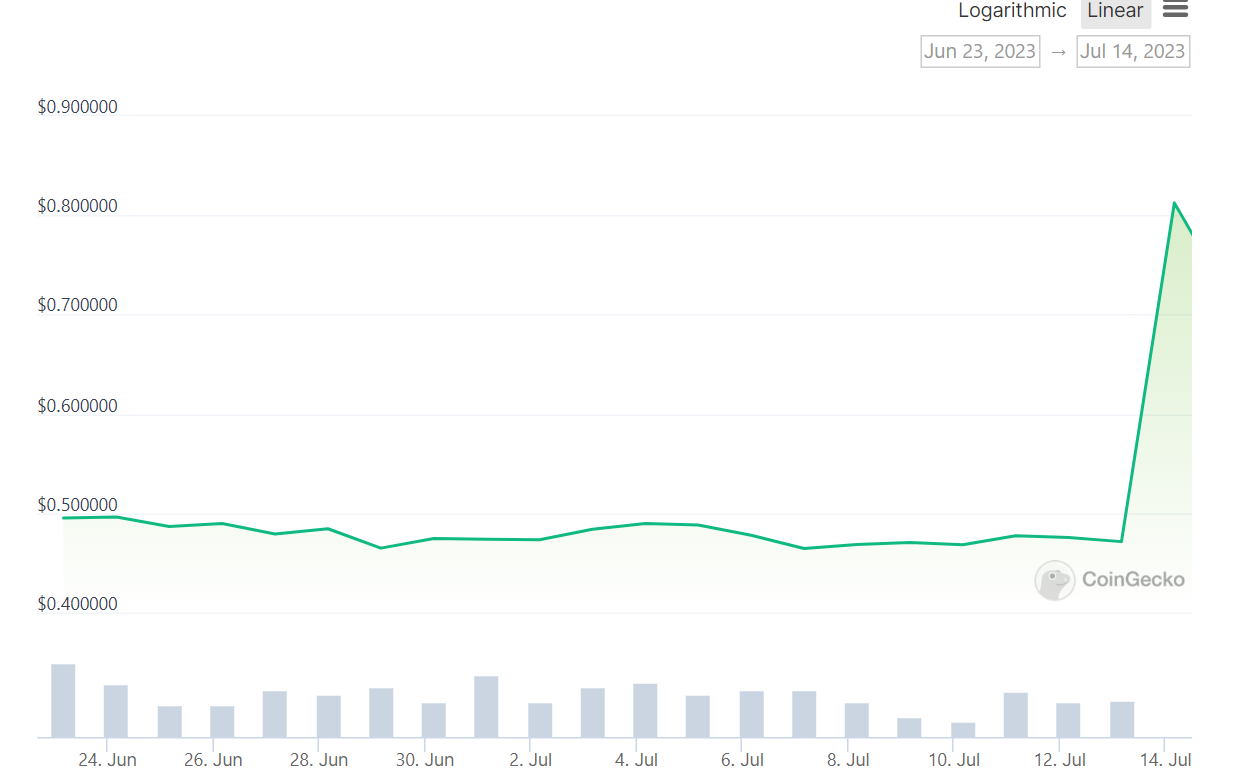

Following the win on 13th July 2023, exchanges listed XRP for trading on their portals. Post-listing, the XRP price went up from $0.47 to $0.82 in just a matter of a few hours.

The current market is mostly driven by retail players and this is the reason, why the real movement in the XRP price is not happening. It’s the institutional investors who can catapult XRP to its real price.

7) Circulating Supply and Escrow Release

Each month, 1 Billion XRPs are released into the Ripple XRP wallets from the XRP escrowed wallets. Out of 1 billion XRPs, few are spent to meet the expenses for running the business, and the remaining XRPs are escrowed back.

Currently, since the XRP price is quite low, massive amounts of XRPs are liquidated in the market, which pushes back the price of XRP each month.

On the contrary, if the XRP price is high, for example, $10,000, to gather $1,000,000 by selling XRPs, Ripple will only need to liquidate 100 XRPs, which will not impact the price of XRPs in the open market.

When will the Price of XRP Move Away from Speculations?

Let’s agree on the fact that Ripple was too early in the market, even before the institutions could figure out the difference between Bitcoin and a Blockchain. Furthermore, the financial sector is the most sluggish sector to adapt any new technology. Political favorites and the private sector apprehensions are the 2 biggest reasons for the slow adoption.

However, the good news is that the ecosystem is getting ready and it’s just a matter of time. Let’s look at the following events to get a fair idea of how close we are:-

- Let’s be honest to accept that the XRP ledger is the only blockchain that can transfer cross-border payments for just pennies and at the same time, also help banks get back the trapped capital in nostro and vostro account.

- Ripple’s ODL is gaining traction and institutions realizing the benefit are getting onboard, especially in corridors like Japan to Africa, where the liquidity is quite low and can be easily managed with XRP. A recent partnership with Onafriq in Africa, is one such example.

- Once the mainstream adoption of ODL increases, ODL organizations will need high number of XRPs to maintain the liquidity. This is where the XRPs locked up in escrow will be used. This will prevent XRPs from getting dumped into the market every month and thereby skip negatively affecting the price of XRP.

- The Bank of International Settlement (BIS) and the International Monetary Fund (IMF) are working with various central banks across the world, as a group, for framing regulations and CBDC testing. Various successful pilot tests have been conducted and more are in the pipeline. XRP will be used as a bridge currency to interoperate CBDCs.

- The ISO20022 compliance deadline is not far away. Although the deadline for compliance is 2025, there are a lot of banks, which have already implemented all the modules of ISO20022. Since the base infrastructure required for the messaging standard is being implemented by BIS and IMF, therefore, Ripple will now need to spend less time to onboard these banks onto the XRP ledger.

- Ripple is getting immense support from Brazil, India, Dubai, Australia, United Kingdom, Europe, Singapore, Hong Kong, Japan, South Korea, and Africa in terms of partnerships with institutions as well as license grants for operating business in their territory. 2023, has proved to be a pivot year for Ripple’s progress.

- The migration of the workforce from one country to other is quite high at the moment. Economies are booming and so will the cross-border payments. There is no other technology, no other blockchain, that can handle cross-border payments at such a huge scale, except XRP. We are not mentioning this fact lightly.

Since no other blockchain has a say in this game, when the Central Banks along with the institutions and exchanges, as a whole, start using the XRP ledger and XRP for transferring currency, “Flip The Switch” event will happen. In such a situation, there will be no impact of Bitcoin halving or random news articles on the XRP price.

This is when the real XRP price will be seen on the charts, which needs to be in 5 digits, for it to transact cross-border payments efficiently with enough liquidity. This is just cross-border payments. If we take into account the other use cases like tokenization ($10 Trillion Market), CBDC platform, developers ecosystem, and digital custody business, the XRP price is going to be humongous. The XRP price will be entirely driven by Institutions. Retail players will not be able to make even a slight dent in the price ecosystem and this is when, the XRP price will move away from speculations.